(Direction artistique et conception : Jean-Dominique Lavoix-Carli)

Les États-Unis ont planifié une renaissance nucléaire. Ils visent à atteindre une capacité de 300 GWe d'ici à 2050 pour l'énergie nucléaire et envisagent deux scénarios pour atteindre cet objectif (U.S. Department of Energy -DOE, Pathways to Commercial Liftoff: Advanced Nuclear, 30 septembre 2024).

Ce développement du futur parc américain de réacteurs va générer de formidables défis et incertitudes auxquels les Etats-Unis vont devoir faire face (Hélène Lavoix, "Vers une renaissance nucléaire américaine ?” The Red Team Analysis Society, 15 octobre 2024). Qui plus est, les États-Unis vont devoir également être en mesure d'alimenter cette renaissance nucléaire. Cela signifie qu'ils devront d'abord disposer d'uranium, ce qui suppose de l'extraire, avant même de songer à le transformer, de la conversion à la fabrication de combustible par l'enrichissement.

Comment donc les objectifs nucléaires américains se traduisent-ils en termes de besoins en uranium ? Que cela implique-t-il ?

Dans cet article, nous nous concentrons sur les besoins en uranium de la renaissance nucléaire américaine et sur les moyens de les satisfaire, notamment en termes de sécurité d'approvisionnement. Ensuite, avec les article suivant nous examinerons la manière dont les besoins en uranium des États-Unis dans le cadre de la renaissance nucléaire et la politique d'approvisionnement actuelle des États-Unis peuvent avoir un impact sur le marché mondial de l'uranium, notamment à la lumière de l'essor nucléaire de la Chine, avec un retour d'information sur les options américaines en matière d'approvisionnement en uranium.

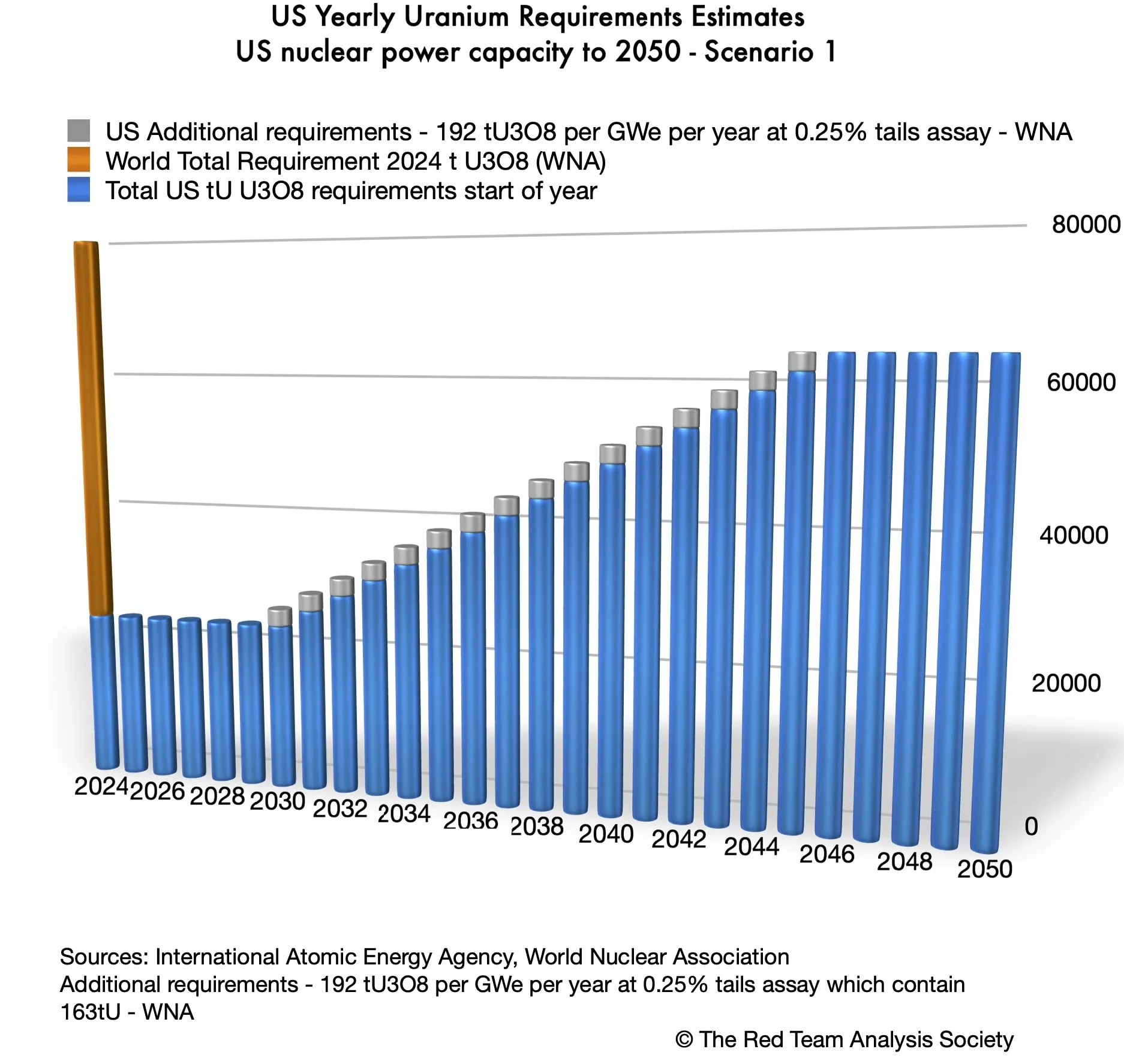

Pour ces deux articles, nous utilisons le scénario 1 du DOE : les unités nucléaires commencent à être construites en 2025 pour être déployées en 2030, et + 13 GWe par an sont ajoutés à partir de 2030 pour atteindre 300 GW de capacité nucléaire en 2050 (US DOE, 2024 Pathways, p. 39).

Examen des besoins en uranium des États-Unis

Selon le DOE, pour atteindre leurs objectifs, les États-Unis devraient "avoir accès à environ 55 000-75 000 tonnes par an de capacité d'extraction et de broyage d'U3O8 pour soutenir 300 GW de capacité nucléaire" (Ibid. p.57).

Les besoins actuels des États-Unis en uranium sont de 21 388 tU sous forme d'U3O8 (18 137 tU - WNA, "World Nuclear Power Reactors & Uranium Requirements", 1 Oct 24).

Si nous supposons que tous les nouveaux réacteurs construits sont au minimum de 3ème Génération(1) (Gen III), on peut considérer que les nouveaux besoins en uranium correspondent à 192 tU sous forme d'U3O8 par GWe et par an à un dosage des résidus de 0,25% (WNA, "Nuclear Fuel Cycle Overview", 24 mai).(2)

Ainsi, le passage à une capacité nucléaire de 300 GW par étapes de 13 GW par an à partir de 2030, comme prévu dans le scénario 1, correspond à une augmentation des besoins en uranium de 2.496 tU en U3O8 par an, à partir de 2029-2030. Par conséquent, à partir de 2045-2046, les États-Unis devront augmenter chaque année leur approvisionnement en uranium d'au moins 61.324 tU en U3O8.

Qu'est-ce que cela représente exactement, à part le fait de devoir répondre à un triplement des besoins en uranium ?

Les premières livraisons supplémentaires sous forme de combustible (et non d'U3O8) devront avoir lieu pour 2030. Cela signifie que pour le déploiement d'un réacteur nucléaire en 2030, l'ensemble du cycle du combustible devra avoir eu lieu avant que le réacteur ne soit chargé pour le premier programme d'essai, lequel dure quelques mois, avant la connexion au réseau. Ainsi, en termes de calendrier, il faut tenir compte du fait que l'uranium extrait et transformé en yellowcake doit ensuite passer par les étapes de conversion, puis d'enrichissement, puis de fabrication du combustible pour être chargé à temps dans un réacteur nucléaire. Cela implique également le transport. Par conséquent, les besoins présentés dans le tableau ci-dessous correspondent à ce qui est nécessaire pour une année spécifique, et non au moment de l'achat, lequel doit avoir lieu auparavant afin de permettre au cycle complet de fabrication du combustible de se dérouler.

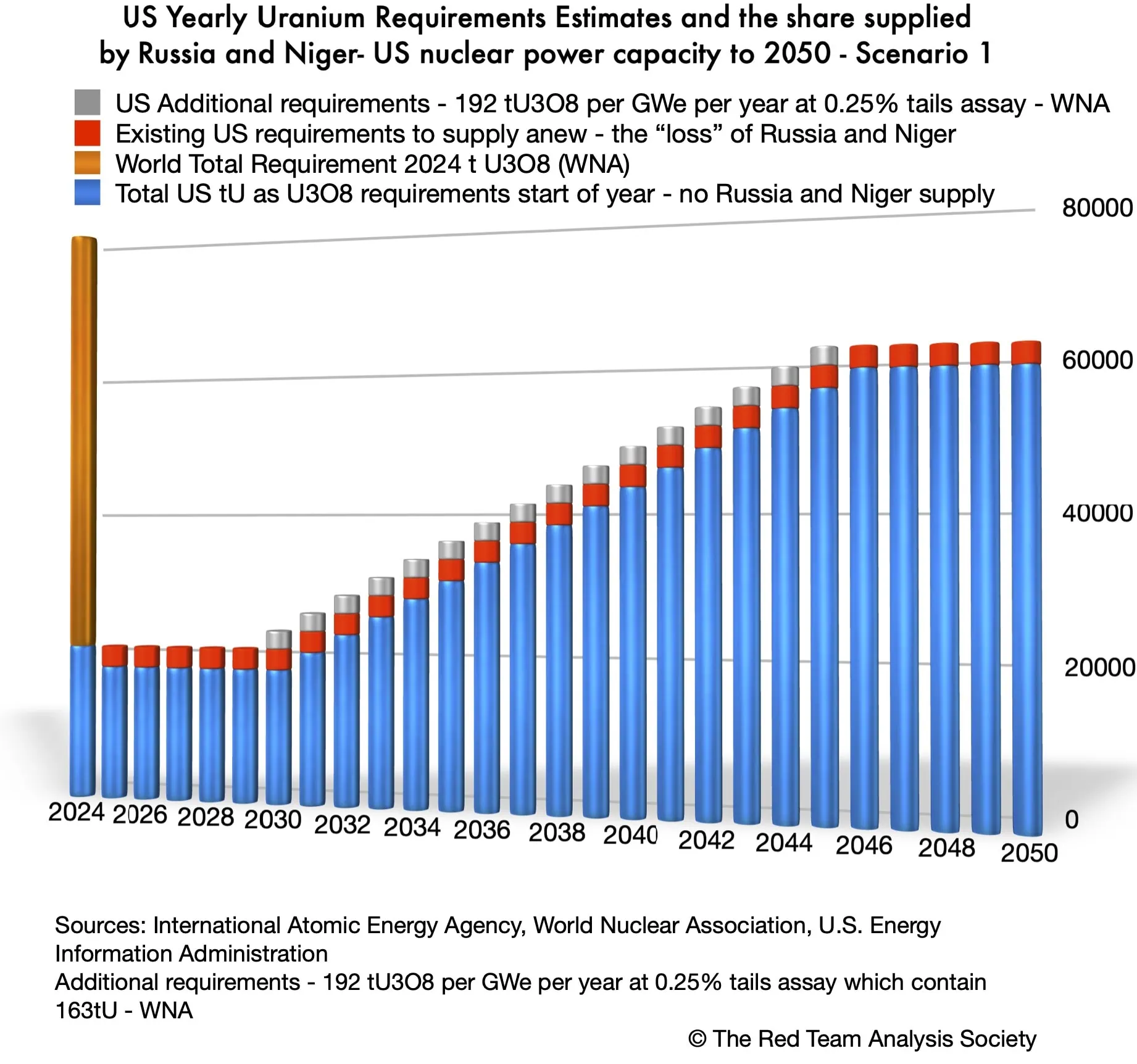

Pour le scénario 1, le profil des besoins américains en uranium pourrait se présenter comme portrayé dans le graphique ci-dessous :

Les quantités d'uranium à fournir sont énormes. À partir de 2045, elles représentent environ 80% des besoins en uranium du monde entier pour 2024.

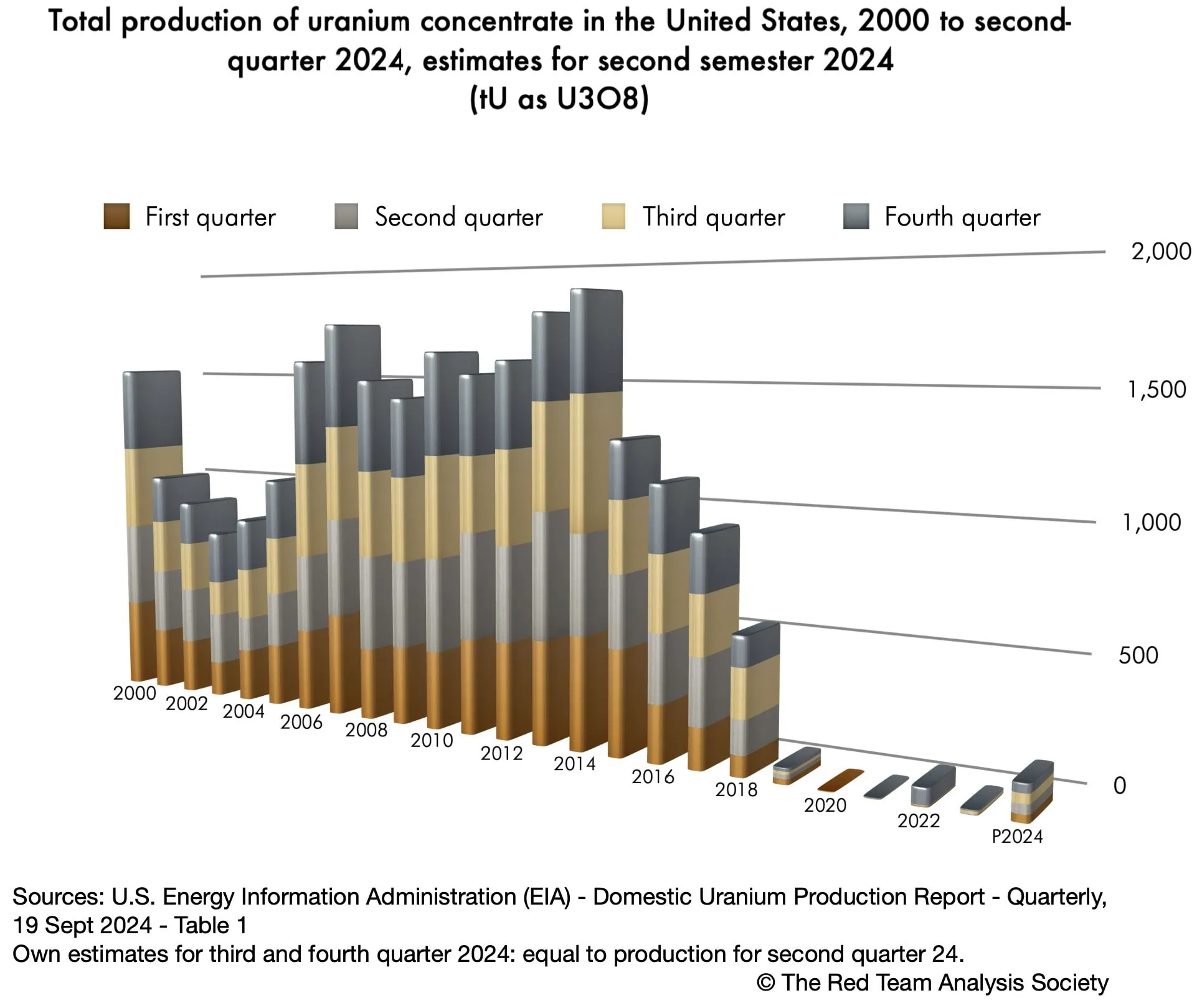

Si l'on compare les besoins en uranium des États-Unis à leur production, comme le montre le graphique ci-dessous, l'immense défi que représente l'approvisionnement de la renaissance nucléaire américaine devient plus évident.

En effet, à son apogée en 2014, la production américaine d'uranium a atteint 1.881 tU sous forme d'U3O8 (U.S. Energy Information Administration, Domestic Uranium Production Report, Quarterly 19 Sept 2024, Table 1). Depuis lors, elle est tombée à presque zéro, avec une timide reprise en 2024. Ainsi, le premier besoin supplémentaire d'uranium nécessaire aux plans nucléaires américains représente déjà 1,33 fois le maximum que les États-Unis aient jamais été en mesure de produire. Accessoirement, le pic de production américain de 2014 est inférieur aux 2.000 tU en U3O8 par an de capacité mis en avant dans le document du DOE, 2024 Pathways (p. 57), sans parler de la production 2019-2024.

Actuellement, sans même tenir compte d'une quelconque augmentation de capacité de production d'énergie nucléaire, les besoins nucléaires américains représentent plus de 11 fois le pic de production d'uranium des États-Unis de 2014.

Comment les États-Unis répondent-ils donc à leurs besoins en uranium ? La compréhension de leur politique actuelle d'approvisionnement en uranium devrait nous aider à envisager la manière dont ils pourront faire face à leurs besoins futurs et les défis qu'ils devront relever.

Acheter de l'uranium plutôt que d'en produire

Comme le souligne le DOE, les États-Unis ont "acheté ~22.000 MT" (2024 Pathways..., p. 57). Cela signifie évidemment que ce que les États-Unis ne produisent pas sur leur territoire est acheté ailleurs.

En 2023, la quantité totale d'uranium livrée aux États-Unis était de 19.847,8 t U3O8e, soit une augmentation de 27 % par rapport à 2022. Cette augmentation peut correspondre à la connexion au réseau des réacteurs de Vogtle, ou à une moindre utilisation de l'uranium stocké, ou aux deux. Elle représente 93,27% des besoins des États-Unis pour 2023 (WNA, World Nuclear Power Reactors & Uranium Requirements, Déc. 2023).

Une réduction de l'implication américaine dans l'extraction de l'uranium, sur le territoire national et à l'étranger

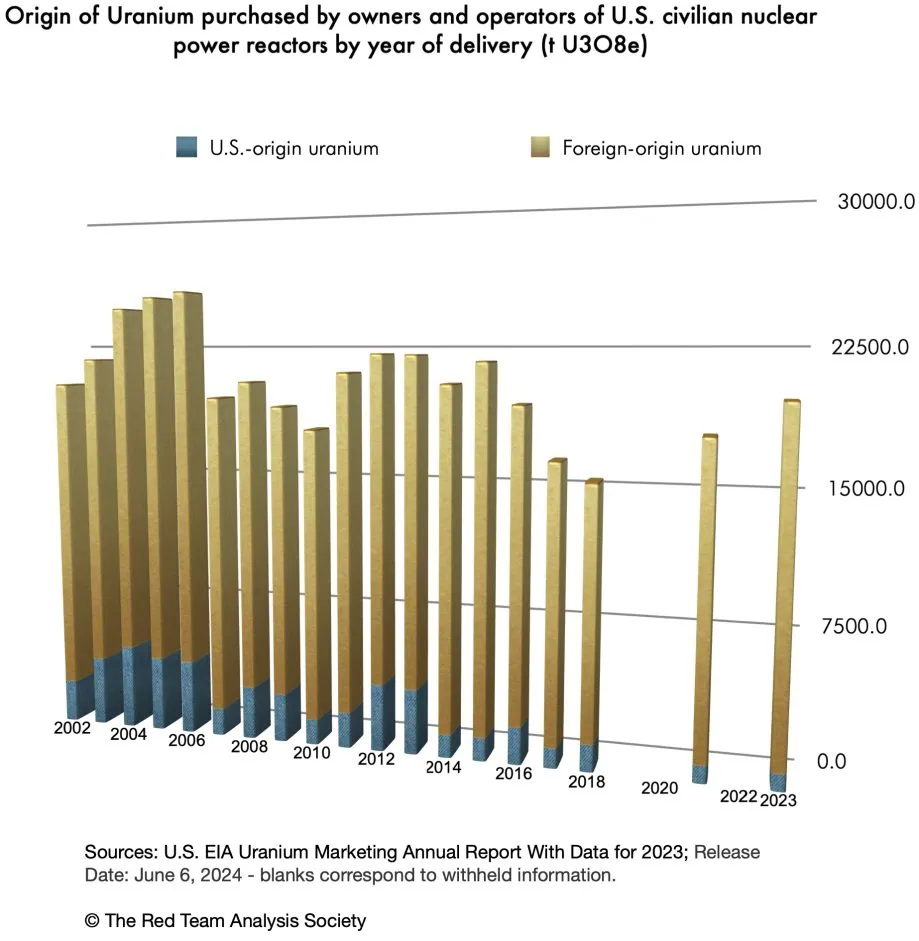

Les États-Unis sont confrontés à un double défi, comme le montrent les deux graphiques suivants.

Insuffisance des gisements d'uranium sur le territoire américain

Tout d'abord, comme on pouvait s'y attendre au vu des chiffres de production d'uranium, seuls 4,65% de l'uranium livré provenaient des États-Unis, c'est-à-dire de gisements américains, tandis que 95,35% provenaient de pays étrangers (premier graphique). La situation américaine par rapport au début des années 2000 s'est aggravée, puisque la production d'uranium s'est effondrée depuis 2016.

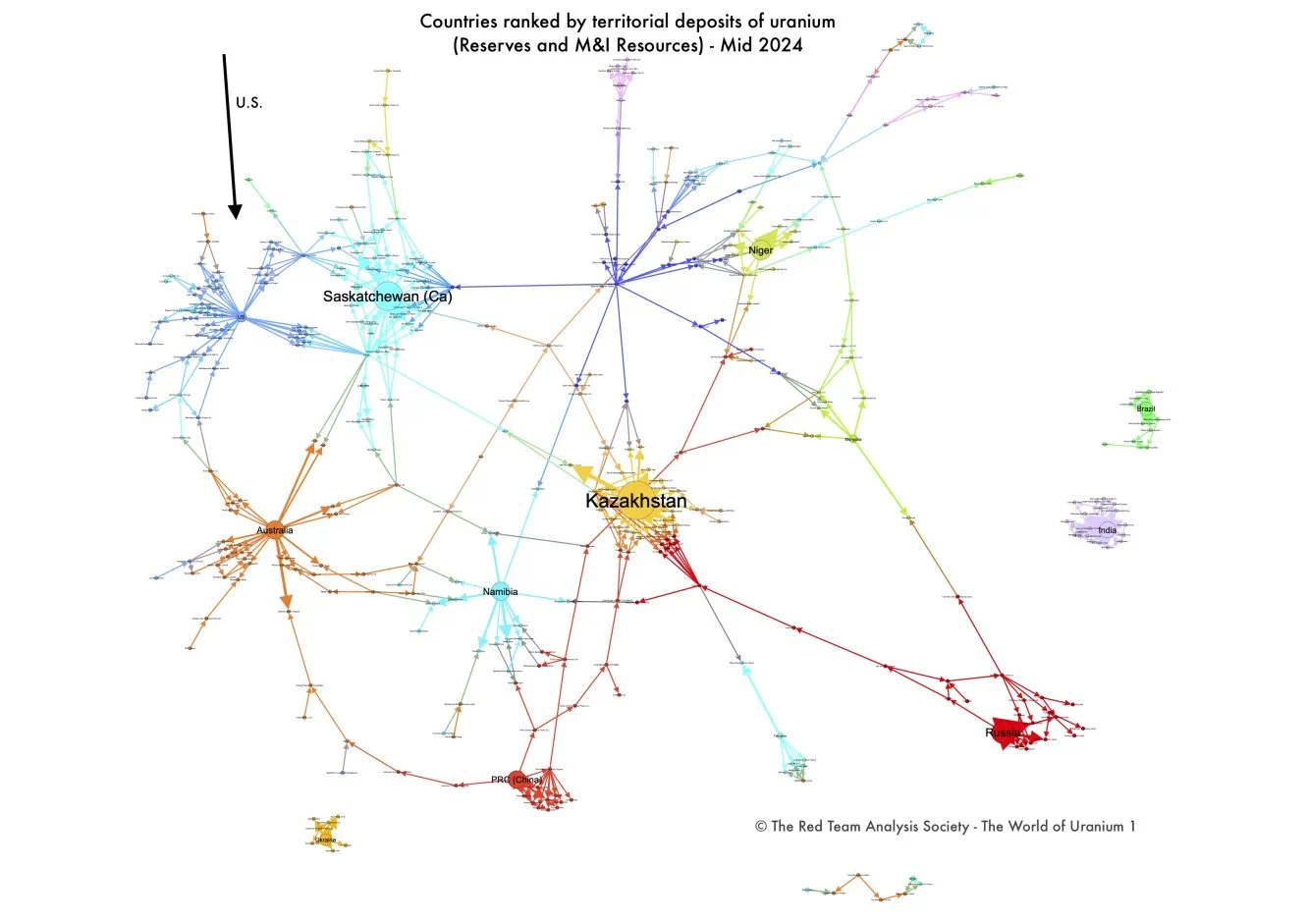

Par rapport à tous les autres pays producteurs d'uranium, en effet, les États-Unis sont loin d'être en tête en termes de réserves et de ressources d'uranium. Si l'on additionne les réserves et les ressources mesurées et indiquées de 126 mines du monde entier dont les réserves et les ressources sont connues, les États-Unis se classent au 12e rang pour les gisements situés sur leur territoire géographique (cf. Le monde de l'uranium - 1: Mines, États et entreprises - Base de données et graphique interactif).

Ces gisements, si l'on ajoute toutes les mines évaluées sur le territoire américain, s'élèvent néanmoins à 147.820 tU sous forme d'U3O8 (Ibid.). Cependant, cela ne correspond qu'à 6,77 années de besoins en uranium pour 2023, et à 2,41 années de besoins en uranium à partir de 2045-2046.

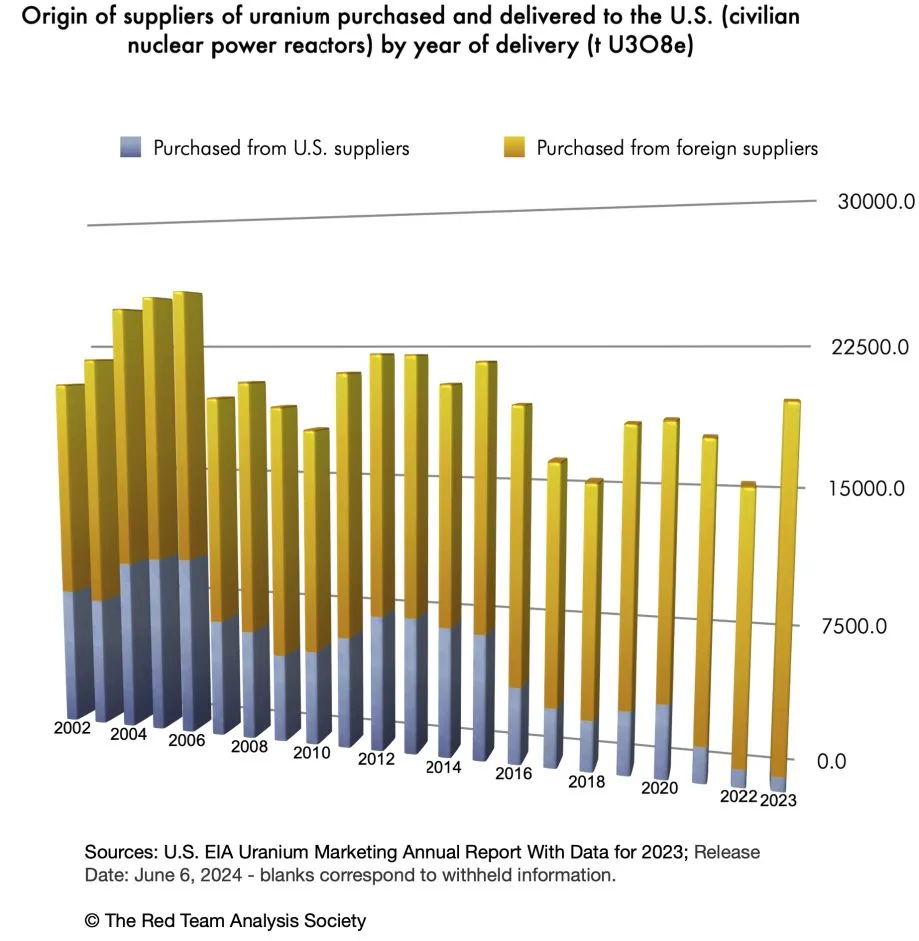

Dépendance écrasante à l'égard des fournisseurs étrangers

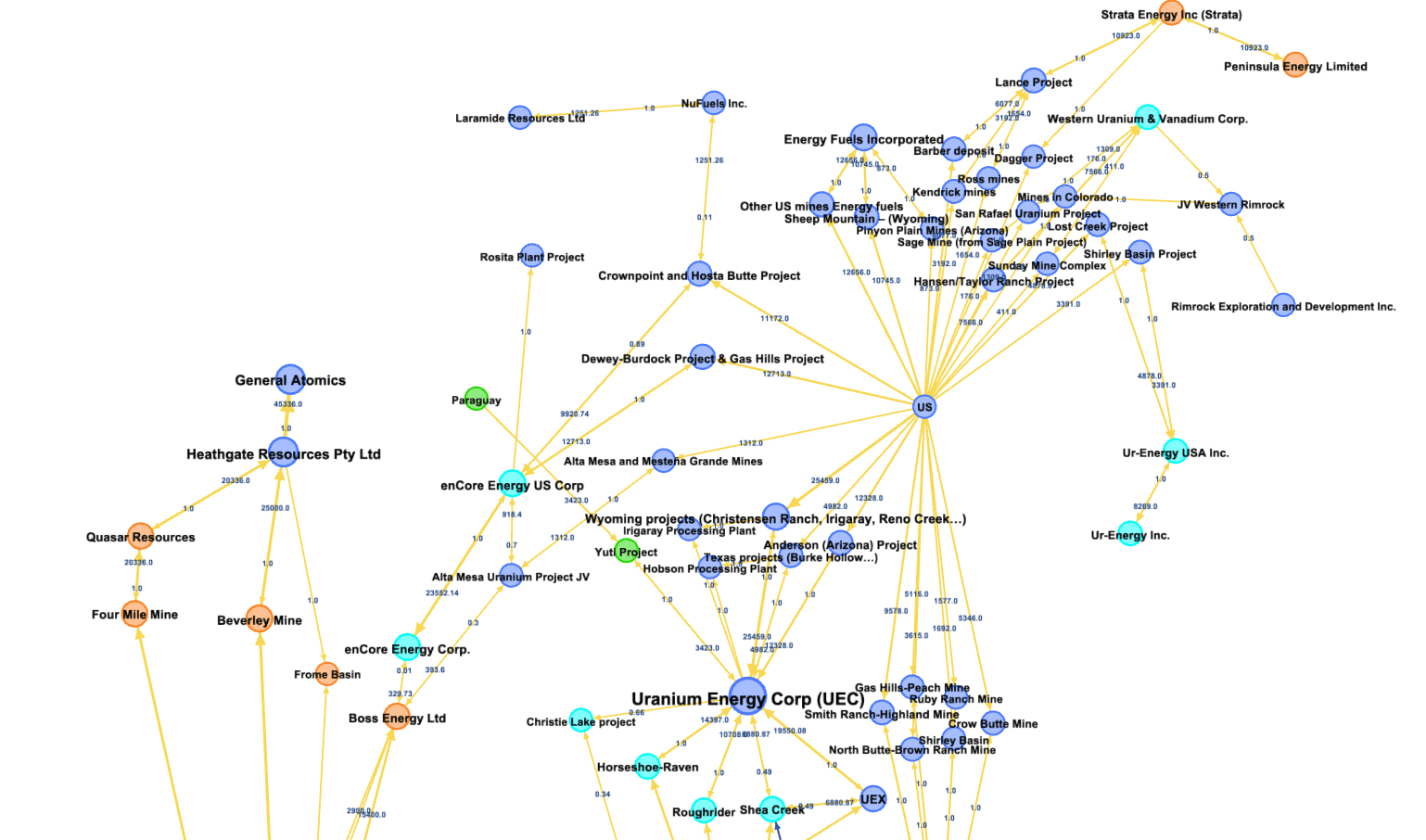

Deuxièmement, seulement 3,88% de l'uranium livré aux États-Unis ont été achetées par des fournisseurs américains, tandis que 96,12% ont été achetées par des fournisseurs étrangers (deuxième graphique). Là encore, la situation s'est considérablement aggravée au cours des deux premières décennies du millénaire, ce qui témoigne du désintérêt des entreprises américaines pour l'uranium.

Qui plus est, les deux graphiques ci-dessus montrent que non seulement la production nationale américaine est faible, mais qu'elle est également assurée en partie par des entreprises étrangères, ce que confirme le graphique ci-dessous (créé avec Le monde de l'uranium - 2). Des sociétés australiennes et canadiennes, en effet, détiennent des parts dans les gisements d'uranium américains.

Par ailleurs, les compagnies minières américaines détiennent, au niveau mondial, relativement peu de réserves et de ressources. Comme elles ont été peu impliquées à l'étranger, à l'exception de quelques mines détenues au Paraguay, en Australie et au Canada, leur part des réserves et des ressources à l'étranger est relativement peu importante (voir Le monde de l'uranium - 2: Mines, États, sociétés et parts de réserves et de ressources - Base de données et graphique interactif).

Dépendance à l'égard des entreprises étrangères et de l'approvisionnement en uranium à l'étranger

Par conséquent, avec peu de production sur le territoire national ou à l'étranger, les États-Unis dépendent abondamment de l'achat auprès de sociétés étrangères d'uranium extrait à l'étranger, principalement par le biais de contrats à long terme (84,08% en 2023) et sur le marché au comptant (14,92% en 2023) (U.S. Energy Information Administration, "Table S1a. Uranium acheté par les propriétaires et les exploitants de réacteurs nucléaires civils américains, 2002-2023", 2023 Uranium Marketing Annual Report, juin 2024).

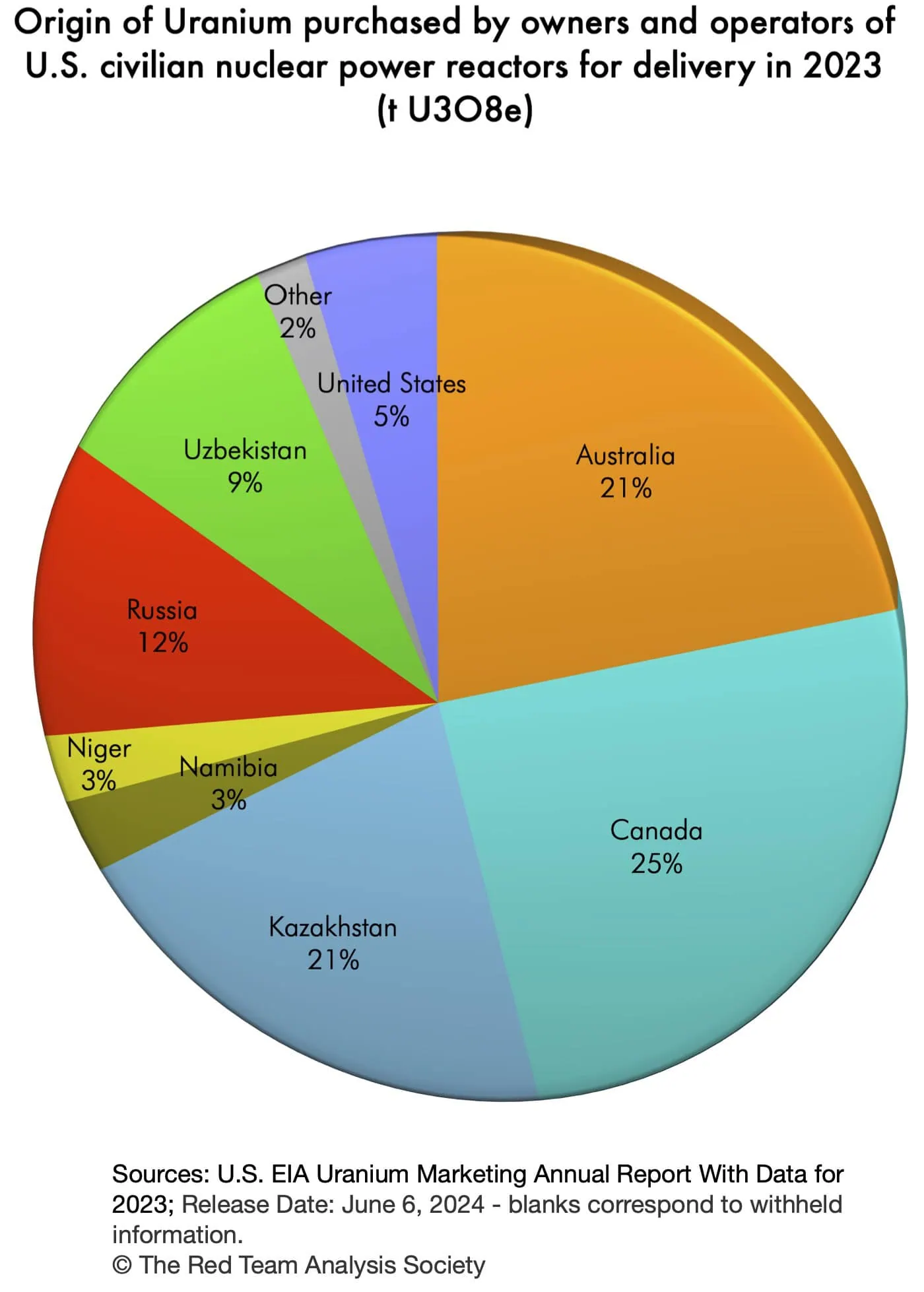

Les pays auprès desquels l'uranium livré en 2023 a été acheté sont indiqués dans le graphique ci-dessous :

Comme nous allons le voir maintenant, cette dépendance américaine à l'égard de l'uranium étranger et des opérateurs étrangers fragilise la sécurité de l'approvisionnement en uranium des États-Unis compte tenu de la politique internationale.

Quand la dépendance à l'égard de l'uranium étranger fragilise la sécurité de l'approvisionnement en uranium

Perte de l'uranium de la Russie et du Niger ?

En supposant que la nouvelle administration Trump 2025 ne modifie pas les politiques de 2024 et ne s'efforce pas de rétablir les relations avec la Russie, au 1er janvier 2028 et à la fin du régime d'exemption des sanctions russes, la Russie ne devrait plus être une source d'uranium pour les États-Unis.

En fait, compte tenu de la décision russe d'interdire temporairement l'exportation d'uranium enrichi vers les États-Unis, avec des exceptions en fonction des intérêts russes, la nécessité pour l'Amérique de ne pas dépendre de l'uranium russe pourrait être beaucoup plus proche dans le temps, voire immédiate (Jonathan Tirone, Ari Natter et Will Wade, "Russia takes aim at US nuclear power by throttling uranium“, Mining.com, 15 novembre 2024).

La nécessité de remplacer l'uranium russe pourrait également ne durer "que" tant que la politique américaine à l'égard de la Russie ne changera pas, tout en étant un enjeu parmi d'autres dans d'éventuels changements futurs des relations entre les États-Unis et la Russie.

Il est également probable qu'à l'avenir, le Niger ne soit plus non plus, pour les Etats-Unis, une source d'uranium, compte tenu des développements internationaux (voir Hélène Lavoix, Niger : une nouvelle menace grave pour l'avenir de l'énergie nucléaire française ?, The Red Team Analysis Society, 21 juin 24 ; RTI, "Niger embraces Russia for uranium production leaving France out in the cold" 13 novembre 2024).

Par conséquent, toujours dans l'hypothèse d'une poursuite de la politique de l'administration Biden à l'égard de la Russie par l'administration Trump, en plus des besoins futurs nécessaires à leur renaissance nucléaire, les États-Unis pourraient également avoir besoin de sécuriser annuellement 2.869 tU sous forme d'U3O8 pour remplacer l'uranium russe et nigérien (U.S. Energy Information Administration, "Table 3. Uranium purchased by owners and operators of U.S. civilian nuclear power reactors by origin country and delivery year, 2019-23", 2023 Uranium Marketing Annual Report, juin 2024).

Plus précisément, les fournisseurs d'uranium des besoins américains doivent sécuriser chaque année ces 2.869 tU sous forme d'U3O8.

Augmentation des besoins en uranium et réduction des sources d'approvisionnement possibles

Par conséquent, même si les besoins fournis précédemment par la Russie et le Niger ne sont pas nouveaux, ils devront néanmoins être satisfaits d'une façon nouvelle. Ce sont donc 2.869 tU en U3O8 par an que les États-Unis doivent se procurer jusqu'en 2029, auxquels s'ajouteront ensuite les 2.867 tU en U3O8 supplémentaires chaque année, correspondant à l'augmentation de la capacité nucléaire du scénario 1. Ainsi, d'une part, les besoins ont augmenté et, d'autre part, l'offre disponible a diminué car les gisements russes et nigériens ne sont plus disponibles, jusqu'à ce que les conditions et les politiques changent.

Les exigences américaines, qui doivent donc être satisfaites, sont indiquées dans le graphique ci-dessous :

Pour illustrer les achats que les Etats-Unis devraient effectuer pour répondre à ces nouveaux besoins américains en uranium dans le cadre du scénario 1, on peut séparer les besoins certains - ceux qui ont été fournis par la Russie et le Niger - des besoins possibles, issus des plans pour la renaissance nucléaire.

Remplacement de l'uranium provenant de Russie et du Niger

Les besoins annuels de 2.869 tU sous forme d'U3O8, qui étaient auparavant couverts par la Russie et le Niger, pourraient désormais provenir de l'augmentation de la production prévue par la société canadienne Cameco et la société française Orano pour leurs usines de Cigar Lake(3) et de McArthur River/Key Lake(4) (pour plus d'informations sur ces entreprises, voir Helene Lavoix, "Revisiter la sécurité de l'approvisionnement en uranium (1), Le monde unique de ceux qui extraient l'uranium“, The Red Team Analysis Society, 21 mai 2024). Si l'on regarde pour ces usines la production de 2023 et qu'on la compare à la production attendue pour 2024, l'augmentation de la production pour les deux sites est de 2.847 t d'U sous forme d'U3O8, ce qui correspond à peu près à ce qui est nécessaire pour couvrir les besoins américains en remplacement de la Russie et du Niger. Dans cette hypothèse, nous imaginons que les partenaires des deux mines et usines vendent toute la production supplémentaire aux Etats-Unis.

| Cigar Lake / McLean Lake mill Mlbs | tU en U3O8 | McArthur River / Key Lake mill Mlbs | tU en U3O8 | Total Mlbs | tU en U3O8 | Augmentation | |

|---|---|---|---|---|---|---|---|

| 2023 | 15.1 | 5808.17 | 13.5 | 5192.73 | 28.6 | 11000 | |

| 2024 | 18 | 6923.65 | 18 | 6923.65 | 36 | 13847 | 2847 |

| Capacité maximale | 18 | 6923.65 | 25 | 9616.17 | |||

| Durée de vie restante de la mine (années) | 13 | 16 | |||||

| Fin de la production - (approx.) | 2037 | 2040 18 Mlbs/an |

En 2038 et 2041, cependant, ces mines auront atteint leur fin de vie et d'autres sources d'approvisionnement devront être trouvées.

En attendant, comme nous le verrons dans le prochain article, où nous examinerons l'impact des besoins américains en uranium sur le marché mondial de l'uranium, puis les répercussions sur l'approvisionnement en uranium, il se peut que toute la production de ces mines ne soit pas vendue aux États-Unis. Dans ce cas, certaines compagnies nucléaires américaines devraient trouver ailleurs d'autres sources d'approvisionnement. Dans le pire des cas, elles pourraient se retrouver sans avoir suffisamment d'uranium pour alimenter leurs réacteurs, ce qui pourrait entraîner des pénuries d'électricité.

Approvisionnement pour les nouveaux besoins en uranium de la renaissance nucléaire américaine

Les principales mines et usines de production existantes au Canada ont déjà été utilisées dans notre hypothèse pour remplacer l'uranium russe et nigérien (Commission canadienne de sûreté nucléaire, Operating uranium mines and mills – Rabbit Lake est actuellement en entretien et maintenance et il y reste 14.847 tU de ressources indiquées).

Les États-Unis devront donc acheter de l'uranium ailleurs. Cela nécessite de démarrer l'exploitation de nouvelles mines, comme nous le verrons dans le prochain article.

Ainsi, chaque année, les nouveaux besoins supplémentaires des États-Unis découlant du scénario 1 représenteraient l'équivalent de 10,6% à 11% de l'ensemble de la production kazakhe de 2024, qui devrait atteindre entre 22.500 et 23.500 tU (mise à jour de l'orientation de la production de 2024, "Kazatomprom 1H24 Financial Results and 2025 Production Plan Update", 23 août 2024). Le Kazakhstan est le premier producteur d'uranium au monde.

Cela signifie que pour 2030, les États-Unis auraient besoin de l'équivalent de 10,6% à 11% de la production kazakhe. En 2031, ils auraient besoin de nouveau de 10,6% à 11% supplémentaires, et donc absorberaient l'équivalent de 21,2% à 22% de la production kazakhe. Pour 2032, ils auraient à nouveau besoin de 10,6% à 11%, et absorberaient donc l'équivalent de 31,8% à 33% de la production kazakhe, etc.

A partir de 2045, chaque année, en considérant la totalité des besoins américains, les Etats-Unis absorberaient l'équivalent de près de trois fois la totalité de la production kazakhe de 2024. Les Etats-Unis devront donc "trouver trois Kazakhstan" chaque année pour toujours ou tant que leur capacité d'énergie nucléaire se maintiendra à 300 GWe.

Il s'agit de quantités sans précédent.

Or, l'extraction, la production et le commerce de l'uranium sont des activités qui se déroulent au niveau mondial : les actions d'un acteur à une extrémité de la planète ont un impact sur l'ensemble de l'échiquier mondial de l'uranium, ce qui a en retour des conséquences pour chacun des acteurs. Par conséquent, avant d'examiner les options qui s'offrent aux États-Unis, nous devons d'abord replacer les besoins en uranium des États-Unis dans leur contexte global. L'uranium pour la renaissance nucléaire américaine - 2 : Vers une course géopolitique mondiale.

Notes

(1) Les réacteurs nucléaires avancés comprennent les réacteurs de génération III (Gen III), de génération III+ (Gen III+) et de génération IV (Gen IV) (voir, par exemple, WNA, "Advanced Nuclear Power Reactors", avril 2021).

(2) Ces estimations des besoins en uranium sont un minimum. En effet, si un réacteur d'une technologie plus ancienne est remis en service, comme cela risque d'être le cas, les besoins en uranium seront plus élevés (pour une synthèse rapide concernant les générations (GEN) de réacteurs et les remises en service, Lavoix "Vers une renaissance nucléaire américaine ?“).

(3) Cigar Lake appartient à Cameco à hauteur de 54,547%, à Orano Canada Inc. à hauteur de 40,453% (Orano) et à TEPCO Resources Inc. à hauteur de 5%.

(4) L'usine de Key Lake est détenue à 83,333% par Cameco et à 16,667% par Orano.

Laisser un commentaire