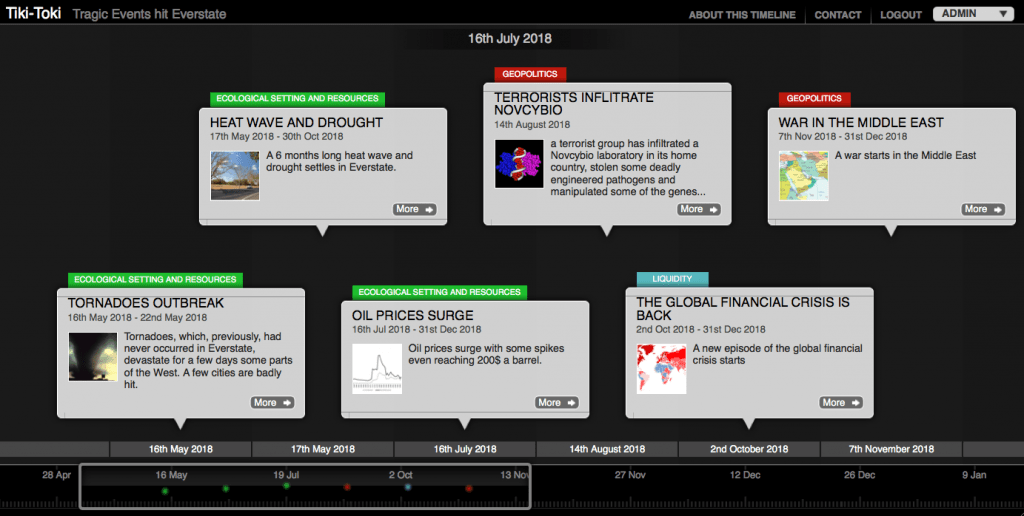

Tragic events strike Everstate. We witness tornadoes and drought, war in the Middle East and even a major industrial accident, while a new episode of financial crisis starts. These are instances of the various conditions presiding to Everstate’s destiny, considering what has been done, or not, globally, regionally, and within Everstate.

The same set of events should be used to stress test each scenario. The logic of the scenario will however come first, assuming it impacts the plausibility of the event. In that case, the events will be presented as impacted by the scenario.

A typical year

Pressures and events that could take place in the short to medium-term future (up to 10 years).

- In May, tornadoes, which, previously, had never occurred in Everstate, devastate for a few days some parts of the West. A few cities are badly hit. (1)

- Tornadoes are followed by a 6 months long heat wave and drought. (2)

- During the same summer, energy prices surge with some spikes corresponding to an oil price of 200$ a barrel (to adapt for each type of energy). (3)

- Novcybio is a foreign international company developing new biotechnologies. An Everstatan company, Novcybio Everstate, has various commercial and industrial relations with Novcybio. In August, global media report that a terrorist group has infiltrated a Novcybio laboratory in its home country, stolen some deadly engineered pathogens and manipulated some of the genes experimented, altering and recombining the DNA sequence of some of the transgenic plants created. (4)

- In October, a new episode of the global financial crisis starts. (5)

- In November a war starts in the Middle East.

Ideally, up-to-date and available scientific knowledge should guide the choice of events and the design of their occurrence.

The related variables in the initial model (e.g. ecological setting, natural new events/conditions/evolution, new external military threats, etc.), which are actually cluster variables, could themselves be developed as specific models for each issue. The different models could then be synthesised to obtain a better understanding and foresight capability. For example, what we know of sea level rise could be linked to the model developed here. Ideally, assuming sufficient resources, we should aim towards the creation of such synthesised models.

Most of the time, when impacts are envisioned, it tends to be done according to only one perspective. In the case of environmental changes, this means most of the time direct costs, sometimes with a larger economic perspective. Even approaches through vulnerability and resilience tend not to be holistic enough, sometimes giving up on foresight and warning, most of the time oblivious of political and geopolitical dynamics. Such partial approaches are absolutely insufficient.

Indeed, as we shall test with the scenarios here, and as shown by the cases of Haiti and Japan, both ravaged by deadly earthquakes (2010 Haiti earthquake, 7Mw – 2011 Tohoku Earthquake, 9Mw), it is more than likely that polities in different political conditions will use different capabilities, in various ways, to face changes and duress. Likewise, what will result will probably differ. Only such multidisciplinary approaches can let us hope to reach resilience.

It follows that the timing of those events will generate different consequences. We are again faced with the same challenge, chronology and timing (see “Time in Strategic Foresight and Risk Management”; Creating Evertime). Ideally again, considering different sets of likelihood and timing for each event should allow us combining different sets of events. Each should be tested against the conditions of the polity for this very specific timing. Adequate computing and Artificial Intelligence facilities would be necessary.

Anticipating other events

Users and Readers can imagine other sets of events that could befall Everstate the same year, or the following years. The methodology used allows to (relatively) easily adapt the narratives.

Notes and references

——–

(1) See List of European tornadoes and tornado outbreaks by Wikipedia. The Tornado & Storm Research Organisation.

(2) See, for example, the European Drought Center; Drought.gov; Professor Lena M. Tallaksen, in her keynote speech “Drought and Low Flow in Europe: Observations and Multi-model simulations” (Abstract) for the 2012 International Symposium on Climate Impacts on Low Flows and Droughts, p.10: underlines that

“Observations suggest that drought in Europe has occurred more frequently in the latter part of the 20th century, however the scientific understanding of the driving forces behind largescale droughts is incomplete. Climate change projections for Europe further indicate that drought is likely to become more frequent and more severe due to warmer northern winters and a warmer and drier Mediterranean region…”

(3) The scenarios below should be revised and adapted to the current and future energy mix, including efforts to reach Net Zero by 2050.

Scenarios on oil prices related to a potential war with Iran and the closing of the Strait of Ormuz led to the following forecasts:

By Pimco republished as “Pimco’s 4 “Iran Invasion” Oil Price Scenarios: From $140 To “Doomsday” by Zerohedge on 29 November 2011:

“i) Scenario 1: Exports minimally effected. Concerns would drive initial price response; Oil could spike initially to $130 to $140 per barrel and then settle in a higher range, around $120 to $125; ii) Scenario 2: Iranian exports cut off for one month. In this case, we would expect prices could reach previous all-time highs of $145/bbl or even higher depending on issues with shipping; iii) Scenario 3: Iranian exports are lost for half a year. We think oil prices could probably rally and average $150 for the six months, with notable spikes above that level; iv) Scenario 4: Greater loss of production from around the region, either through subsequent Iranian response or due to lack of ability to move oil through Straits of Hormuz. This is the Armageddon scenario in which oil prices could soar, significantly constraining global growth…”

By Societe Generale: “SocGen Lays It Out: ‘EU Iran Embargo: Brent $125-150. Straits Of Hormuz Shut: $150-200‘”published by Zerohedge, 8 January 2012:

1) “Scenario 1: EU enacts a full ban on 0.6 Mb/d of imports of Iranian crude. In this scenario, we would expect Brent crude prices to surge into the $125-150 range.” 2) “Scenario 2: Iran shuts down the Straits of Hormuz, disrupting 15 Mb/d of crude flows. In this scenario, we would expect Brent prices to spike into the $150-200 range for a limited time period….”

(4) See, for example, National Research Council. Biotechnology Research in an Age of Terrorism. Washington, DC: The National Academies Press, 2004, notably pp.22-24; Gigi Kwik, Joe Fitzgerald, Thomas V. Inglesby, And Tara O’toole, “Biosecurity: Responsible Stewardship of Bioscience in an Age of Catastrophic Terrorism”, Biosecurity And Bioterrorism: Biodefense Strategy, Practice, And Science, Volume 1, Number 1, 2003; Danny J. Llewellyn, M. Brown, Y. Cousins, L. Hartweck, D. Last, A. Mathews, F. Murray & J. Thistleton. CSIRO Division of Plant Industry P.O. Box 1600 Canberra City A.C.T 2601, “The Science Behind Transgenic Cotton Plants,” Proceedings of the 6th Australian Cotton Conference Broadbeach Qld August 1992; Glenda D. Webber, Office of Biotechnology, Iowa State University, “Insect-resistant crops through genetic engineering“. Biotechnology Information Series, 1995; K.S. Jayaraman, “India investigates Bt cotton claims Research council launches probe into how Monsanto gene ended up in its indigenous transgenic cotton.” Nature, March 2012, doi:10.1038/nature.2012.10015; B. M. Khadi, “Impact of Bt-cotton on Agriculture in India“, GMO Safety.

(5) This renewed financial crisis would come from the assumption that nothing – beyond reducing state expenses – or not much has really been endeavoured in the word to tackle the financial crisis started in 2007. Thus, the crisis regularly surges after temporary lulls. It would be worsened by the impact of oil prices’ increase and spikes on the real economy; read, for a recent paper on this latter point: Dr. Mingqi Li (associate professor of economics at the University of Utah), “Has the Global Economy Become Less Vulnerable to Oil Price Shocks?” The OilDrum, 14 March 2012.