(Art direction and design: Jean-Dominique Lavoix-Carli)

On 30 September 2024, the U.S. Department of Energy (DOE) published the latest edition of the Pathways to Commercial Liftoff: Advanced Nuclear. Its aim is to contribute to accelerate advanced nuclear reactors’ commercial deployment in support of U.S. objectives in terms of nuclear energy, necessary notably to achieve its decarbonization goals. It follows on a first document published in March 2023.

- DeepSeek vs Stargate – China’s Offensive on U.S. AI Dominance?

- Trump Geopolitics – 1: Trump as the AI Power President

- Uranium for the U.S. Nuclear Renaissance – 2: Towards a global geopolitical race

- The New Space Race (1) – The BRICS and Space Mining

- Uranium for the U.S. Nuclear Renaissance – 1: Meeting Unprecedented Requirements

- Fifth Year of Advanced Training in Early Warning Systems & Indicators – ESFSI of Tunisia

- Towards a U.S. Nuclear Renaissance?

- AI at War (3) – Hyperwar in the Middle east

The U.S. DOE document sets the civilian nuclear objectives the U.S. state would like to achieve, and presents arguments to convince American companies including bankers and other financial institutions that they should invest in nuclear energy.

What is the American nuclear renaissance all about? Why is it important knowing, in 2024, the U.S. is still the first civil nuclear power in the world? How does it fit in with the global return to nuclear power? What does it mean for the American National Interest? How does it compare with China’s surge in nuclear energy? Are the U.S. nuclear power objectives feasible?

First, we analyse the factors, including in terms of national security and international influence, that drive the American nuclear energy renaissance and the resulting objectives set, comparing them with China. Second, we look at the two scenarios the U.S. DOE designed to reach the objective in terms of nuclear energy capacity and envision a third worst-case scenario. Finally, we highlight the uncertainty and challenges the U.S. face in making the American nuclear renaissance a reality.

The drivers behind the American nuclear energy renaissance and objectives

We have three main factors or series of factors driving the American nuclear energy renaissance. Two of them are linked to international relations and American national security and, more classically, the last are related directly to the demand for energy constrained by decarbonisation.

Leading an international context favourable to nuclear energy

The renewed U.S. interest in nuclear energy takes place within a favourable global context, the return of nuclear power on the international stage.

The global nuclear renewal officially started in December 2023 at the COP 28 at Dubai with the pledge by 22 countries, supported by the nuclear industry, to treble nuclear energy by 2050 in the framework of the international efforts to reduce to zero GHG emissions for 2050 (see Helene Lavoix, “The Return of Nuclear Energy“, The Red Team Analysis Society, 26 March 2024). The pledge was jointly announced by both American Special Envoy John Kerry and French President Emmanuel Macron, the U.S. and France being then the first two world actors in terms of nuclear energy capacity. As far as the U.S. are concerned, this pledge followed on the first edition, in March 2023, of the Pathways to Commercial Liftoff: Advanced Nuclear, where the objective to treble U.S. nuclear capacity was set. The U.S., thus, did not only commit globally to the pledge to treble nuclear energy but also asserted their leading role by having taken this decision eight months earlier and now seeing the world follow them.

Then, in March 2024, 33 countries, including the U.S., attended the Nuclear Energy Summit, jointly hosted by the International Atomic Energy Agency (IAEA) and Belgium and signed the new “Nuclear Energy Declaration” reaffirming their strong commitment to nuclear energy (Ibid.).

On 19-20 September 2024 the commitment to nuclear energy was reasserted at the second high level conference of the Nuclear Energy Agency (NEA), “Roadmaps to New Nuclear 2024”, aimed at creating a network of government officials and industry leaders to “inform policy and investment decisions for new nuclear capacity and the long-term operation (LTO) of existing reactors” (NEA, Energy ministers and industry CEOs assemble to advance new nuclear deployment, 30 September 2024).

Considering the heavy investments needed for everything nuclear, financial support will be critical to see the global trebling of nuclear energy taking place. On 23 September 24 during the Climate Week, in New York City, at the “Financing the Tripling of Nuclear Energy – Leadership Event”, a group of 14 global financial institutions expressed their support for the pledge to triple nuclear energy capacity by 2050 (World Nuclear Association, “14 Major Global Banks and Financial Institutions express support to Triple Nuclear Energy by 2050“, 23 September 2024).

There is therefore a global determination to make the renaissance of nuclear energy possible on the terms decided at COP 28.

From the U.S. point of view, it is necessary the country remains at the forefront of this international effort and succeeds in carrying out its own nuclear renaissance. Indeed, the energy transition considering climate change, if current ways of life are to be preserved as much as possible, cannot take place without nuclear energy (see Lavoix, “The Return of Nuclear Energy“). Thus, as leading and “galvanizing the world” for a “clean energy transition” is part of the U.S. National Security Strategy., then the U.S. must lead the nuclear renaissance.

Moreover, the U.S. does not only perceives its international role as one of leadership, but being the world leader is both key for its own security and for the security of the world. This fundamental trend of American foreign policy was once more reasserted in the 2022 National Security Strategy, which stated, for example, that “around the world, the need for American leadership is as great as it has ever been” (President Biden, October 2022 National Security Strategy).

“Out-competing China and Constraining Russia”

Spearheading the renaissance in nuclear energy is even more important for the U.S. that nuclear power is also part and parcel of the battle that opposes the U.S. to China and Russia, and was defined in the 2022 National Security Strategy as “out-competing China and constraining Russia” (Ibid., pp. 23-27). The U.S. – and its allies – must combat what America perceives as the emergence of the enemy order – a new international order carried and shaped by China and Russia. Consequently, America’s enemies are identified; they are Russia and China, and they must fought (e.g. Hélène Lavoix “The American National Interest“, “The War between China and the U.S. – The Normative Dimension).

Introducing

Read more…

With an additional focus on the shares of reserves and resources of actors. This powerful tool allows you to visualise and analyse geopolitical influence and company exposure to geopolitics in the uranium mining sector. Its companion report includes 12 use cases and their analysis.

Indeed, to this end, on 17 April 2023, the United States, Canada, France, Japan, and the United Kingdom joined in the Sapporo 5 group, established for “Civil Nuclear Fuel Cooperation”. The members of the group, which will potentially be joined by friendly nations sharing the same vision, will collaborate strategically “on nuclear fuels to support the stable supply of fuels for the operating reactor fleets of today, enable the development and deployment of fuels for the advanced reactors of tomorrow, and achieve reduced dependence on Russian supply chains” (Department of Energy, “Statement on Civil Nuclear Fuel Cooperation Between the United States, Canada, France, Japan, and the United Kingdom“, 17 April 2023). One year later, Sapporo 5 underlined progress, notably regarding uranium enrichment, government-led investments and contracts awarded (Office of Nuclear Energy, “Sapporo 5 Leaders Make Significant Progress in Securing a Reliable Nuclear Fuel Supply Chain“, 18 April 2024).

Further, in May 2024, American sanctions banned imports of Russian uranium products (“Congress Passes Legislation to Ban Imports of Russian Uranium“, Morgan Lewis, 13 May 2024). Waivers will be granted until 1st January 2028 but not afterwards (U.S. Department of State, “Prohibiting Imports of Uranium Products from the Russian Federation“, 14 May 2024). As a result, and considering the other goals and drivers, a major effort will be required at all stages of the nuclear fuel supply chain.

Hence, nuclear energy, from its production to the entire nuclear fuel supply chain is now linked to U.S. role and influence in the world and to its combat against enemies and the emergence of an enemy order.

Demand for energy constrained by decarbonisation

Finally, the last driver or rather series of drivers for the American nuclear renaissance stems from the direct U.S. demand for nuclear energy, itself driven by the American demand for energy, and more particularly electricity, constrained by the need to decarbonise.

This is similar to what is happening worldwide, as seen in “Why nuclear energy increasingly matters” (in “The Return of Nuclear Energy”). However, in the U.S. case, we must also integrate the necessity to lead the global decarbonisation effort, as seen above, and the specificities of American energy demand.

Meeting energy demand is indispensable to make possible economic growth, especially in energy-hungry, notably electricity-hungry, sectors such as datacenters and artificial intelligence, which are key sectors for American economic expansion. Indeed, DOE, building upon in-depth research, highlights that U.S. electricity demand is likely to “more than double by 2050” (Pieter Gagnon, An Pham, Wesley Cole, et al. (2023), “2023 Standard Scenarios Report: A U.S. Electricity Sector Outlook“, Golden, CO: National Renewable Energy Laboratory; John D. Wilson and Zach Zimmerman, “The Era of Flat Power Demand is Over.”, Grid Strategies, Dec 2023; DOE, 2024 Pathways to Commercial Liftoff: Advanced Nuclear, p.9). It stresses the role of datacenters and artificial intelligence in this surge (2024 Pathways to Commercial Liftoff, p.8).

For example, Microsoft seeks approval for an agreement with Constellation Energy according to which it would buy all the power produced by the so far shuttered Three Mile Island Unit 1 (819 MWe) in Pennsylvania for over 20 twenty years (Darrell Proctor, “Microsoft Would Restart Three Mile Island Nuclear Plant to Power AI“, Power, 20 September 2024). As a result, Constellation would plan to invest USD 1.6 bn in the restart, which could take place in 2028 (Brian Martucci, “Constellation plans 2028 restart of Three Mile Island unit 1, spurred by Microsoft PPA“, Utility Dive, 20 September 2024.).

Meanwhile, in March 2024, Amazon (AWS) and Talen Energy Corp., owner of the 2.5-GW Susquehanna nuclear plant, entered into a deal according to the which Susquehanna plant will supply power to AWS over 10 years (Darrell Proctor, “AWS Acquiring Data Center Campus Powered by Nuclear Energy“, Power, 4 March 2024).

Similarly, Goldman Sachs Research estimates that the U.S. overall energy demand will rise 2.4% between 2022 and 2030, 0.9% stemming from datacenters (Goldman Sachs Insights, “AI is poised to drive 160% increase in data center power demand“, 14 May 2024). “Data centers will use 8% of US power by 2030, compared with 3% in 2022” (Ibid.). McKinsey sees this share to reach 11 to 12% by 2030, which would correspond to an additional 50 GW in energy (Alastair Green et al., “How data centers and the energy sector can sate AI’s hunger for power“, McKinsey 17 September 2024).

Considering the other factors, notably decarbonization imperatives and the need to reduce its cost, nuclear energy is a choice energy to meet this supplementary U.S. power demand, as stressed in DOE’s report (Pathways to Commercial Liftoff: Advanced Nuclear, pp. 9-11).

Besides the direct economic benefit, the energy demand factor is thrice important. First, ‘the expansion of America’s prosperity” is a stated part of the American National Interest (National Defense Strategy 2022 Factsheet). Hence being able to provide the right energy for economic development is fundamental for the U.S..

Second, as we saw, one aspect of the American national security strategy is to “out-compete China”. Economically and technologically, this can only be done with a lot of energy, and thus a lot of decarbonized energy. Furthermore, as we shall see below, China has already embarked on an ambitious civil nuclear programme.

Finally, as another facet of the competition with China, artificial intelligence has become a key component of the military. A race takes place between China and the U.S. for military intelligentization – 军事智能化 : intelligent military or military intelligentization (Pang Hongliang, “The dawn of intelligent military revolution is emerging – Interpreting the development trajectory of military technology from the perspective of the US “Third Offset Strategy”, National Defense University, 28 Jan 2016; report to the 19th Party Congress in October 2017, p.49; “Riding the express train of military intelligence development“, PLA Daily, 14 Nov 2017; Helene Lavoix, “Artificial Intelligence, Computing Power and Geopolitics (1)” and (2), June 2018; Jean-Michel Valantin, “AI at War (2) – Preparing for the US-China War?“, 17 September 2024).

In this race to out-compete China, the U.S. fears to be overtaken in this vital field. Some American future assessment of the PLA’s Strategic Support Force (PLASSF) highlight that “complacency could result in the U.S. falling behind China in intelligentized warfare by as early as 2027, with a likelihood of 93-99%” or by 2030 with the same probability (Col (s) Dorian Hatcher, “Intelligentization and the PLA’s Strategic Support Force“, the Army’s Mad Scientist Laboratory, 5 October 2023).

Thus, being able to serve the energy-hungry technologies, and more particularly those which are absolutely necessary to military intelligentization, becomes fundamental for defense and security, and, relatedly for influence.

These drivers and their interactions frame how the U.S. set its nuclear energy objective, as well as the ways and means that will be used to reach this aim.

Setting the nuclear energy objective

DOE, focusing mainly on energy demand in the context of decarbonisation, highlights the need for 200+ GW of new nuclear capacity in the U.S. by 2050 (2023 and 2024 Pathways to Commercial Liftoff, p.11).

The current U.S. nuclear net capacity is 96,952 GWe (IAEA/PRIS), resulting from “94 nuclear reactors operating at 54 sites”, providing approximately “20% of US electricity generation and almost half of domestic carbon-free electricity” (2024 Pathways to Commercial Liftoff, p. 21).

Thus, the objective is to treble the existing capacity by 2050 to reach approximately 300 GWe (Ibid., p.11), which has become the aim of the global framework for a nuclear renaissance.

Two or three scenarios?

The two scenarios of the U.S. Department of Energy

DOE evokes two scenarios to reach the objective of 300 GWe capacity by 2050 for nuclear energy (2024 Pathways to Commercial Liftoff, p. 39). Scenario 1, which is favoured, starts deployment in 2030, and considers that + 13 GWe per year are necessary. For this scenario to be possible, nuclear units must start being constructed in 2025 (Ibid.).

Scenario 2 starts deployment in 2035, and in that case + 20 GW added capacity per year will be necessary (Ibid.).

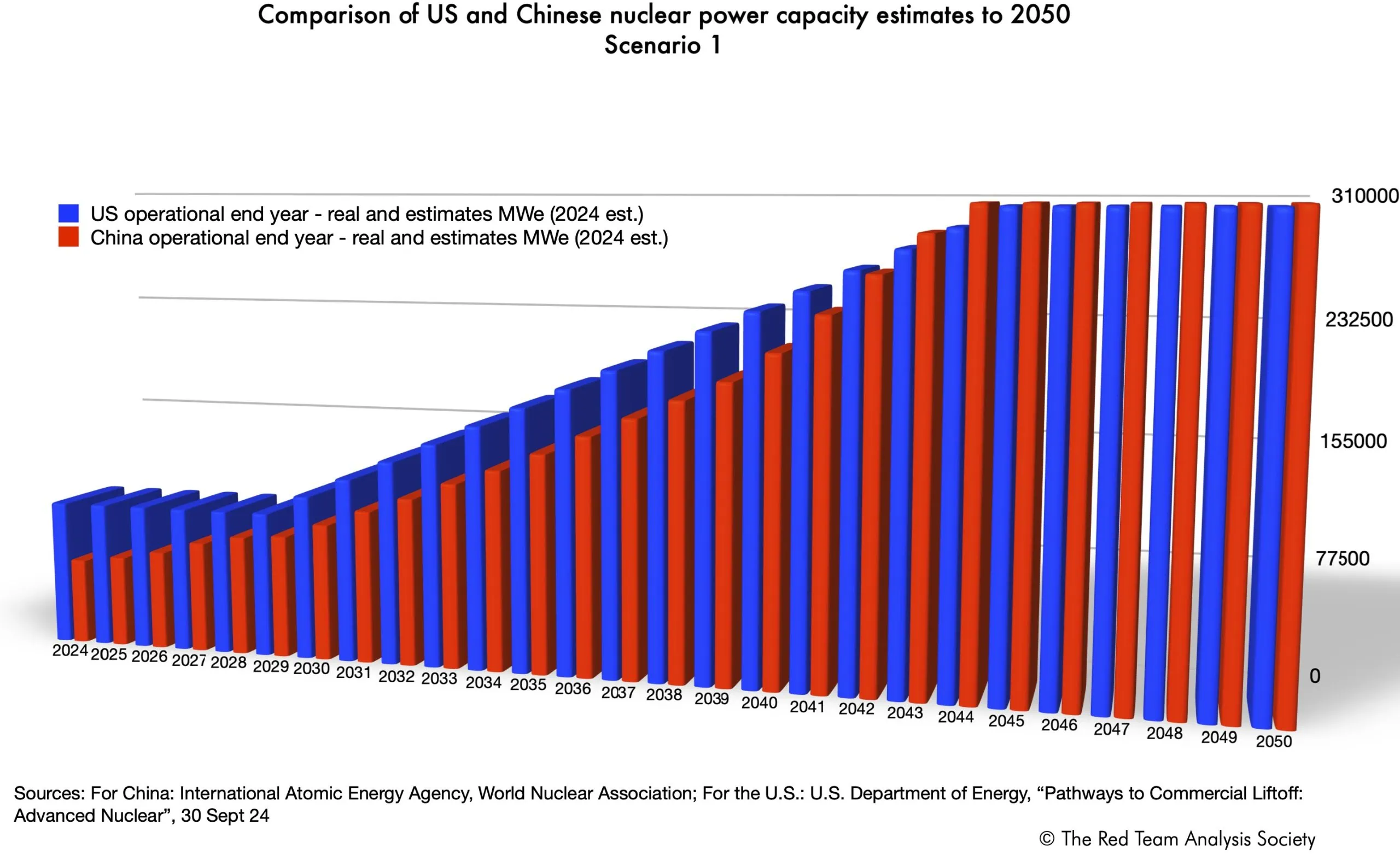

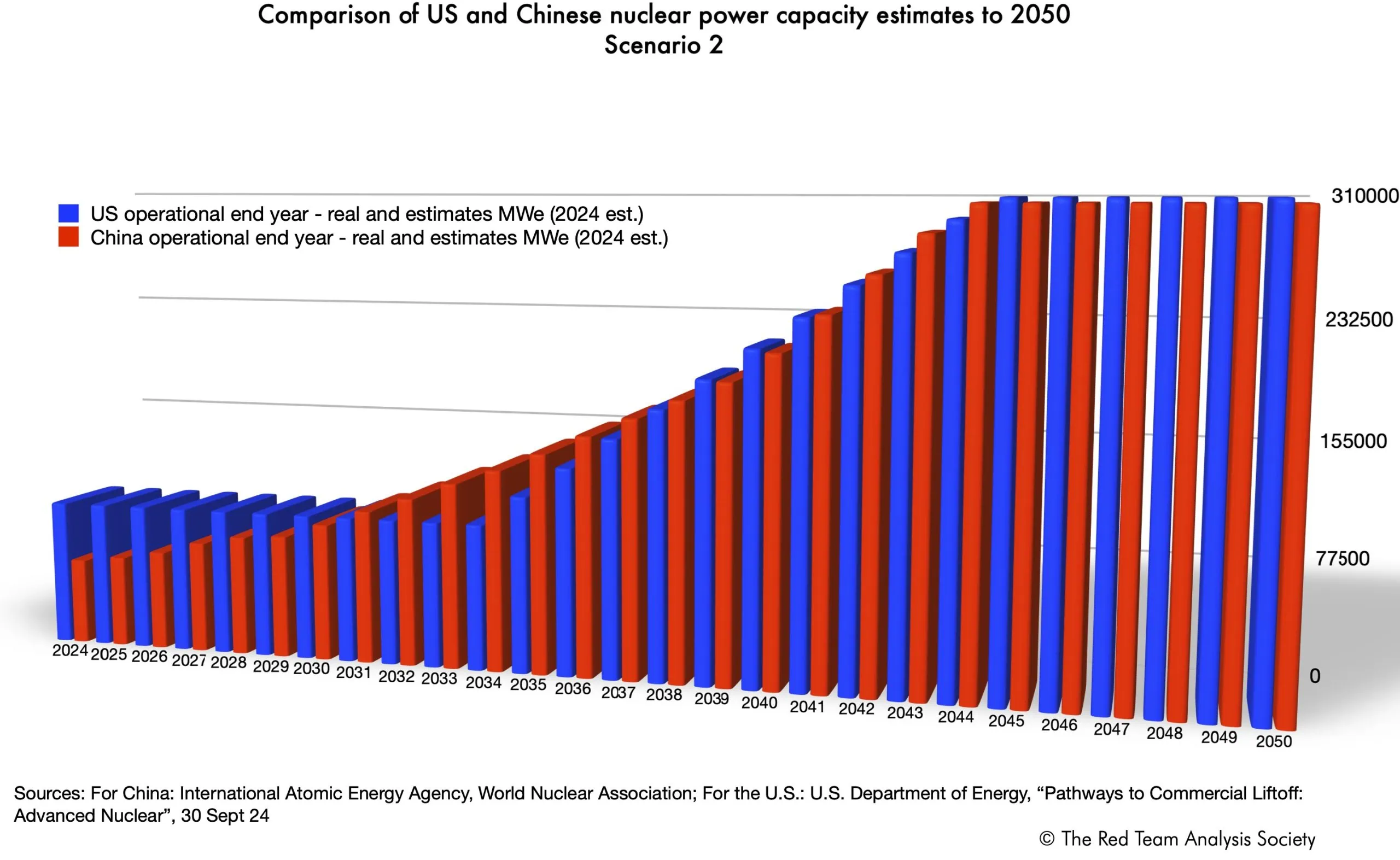

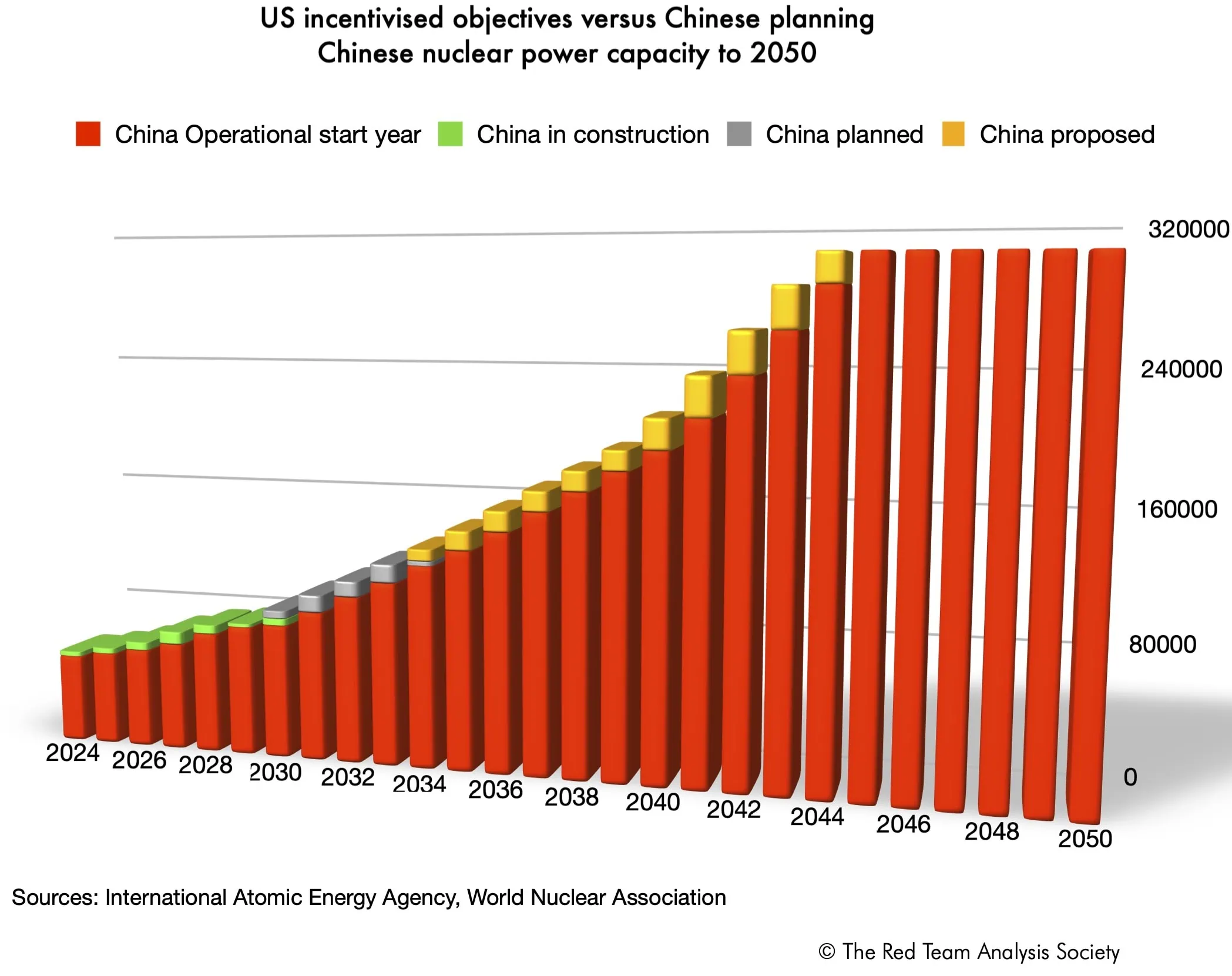

For a better understanding of what these scenarios entail and considering the U.S. willingness to “out-compete” China, we present below two charts, comparing the American objective with China’s surge* in terms of nuclear energy capacity. As far as China is concerned, we use the nuclear units under construction, planned and proposed, as known (World Nuclear Association, “Nuclear Power in China“, updated 13 August 2024, incl. IAEA/PRIS data). For planned and proposed units, building on latest known realisations, we attribute varying years for the start of construction, up to 2039, and then count 5 years until connection to the grid.

Comparison of U.S. and Chinese nuclear power capacity estimates and objectives to 2050

Interestingly, the American objective and the Chinese capacity being built lead to very similar results by the mid-2040s, despite China starting from a smaller nuclear capacity. A race could be taking place between China and the U.S.. However, despite the U.S. will to out-compete China, the objective set is more about being on a par with the Middle-Kingdom.

Keeping in mind that the dates given for Chinese planned and proposed nuclear units are tentative, if we look at the evolution of the American and Chinese positions in the development of nuclear energy capacity, and compare the two scenarios, in the first scenario the U.S. remains ahead of China almost for the whole period. The gap closes towards the end of the period, around 2043. In the second scenario, starting in 2031, China moves ahead of the U.S. and remains in the lead until 2039, when the U.S. finally catches up.

What if there were a third scenario?

There is also an unsaid scenario, which emerges if we only take into consideration nuclear units in construction, planned and proposed and not objectives. This is the approach we used in our article “The Future of Uranium Demand – China’s Surge“*. In this scenario, no new nuclear reactor would be constructed. This is a worst case scenario, where the U.S. would fail to generate enough private interest to trigger the massive investments demanded by nuclear energy.

In that case, by 2031, China would lead the world in terms of nuclear energy production. The U.S. would not catch up.

Uncertainty and Challenges

The uncertainty of “incentive-based objectives”

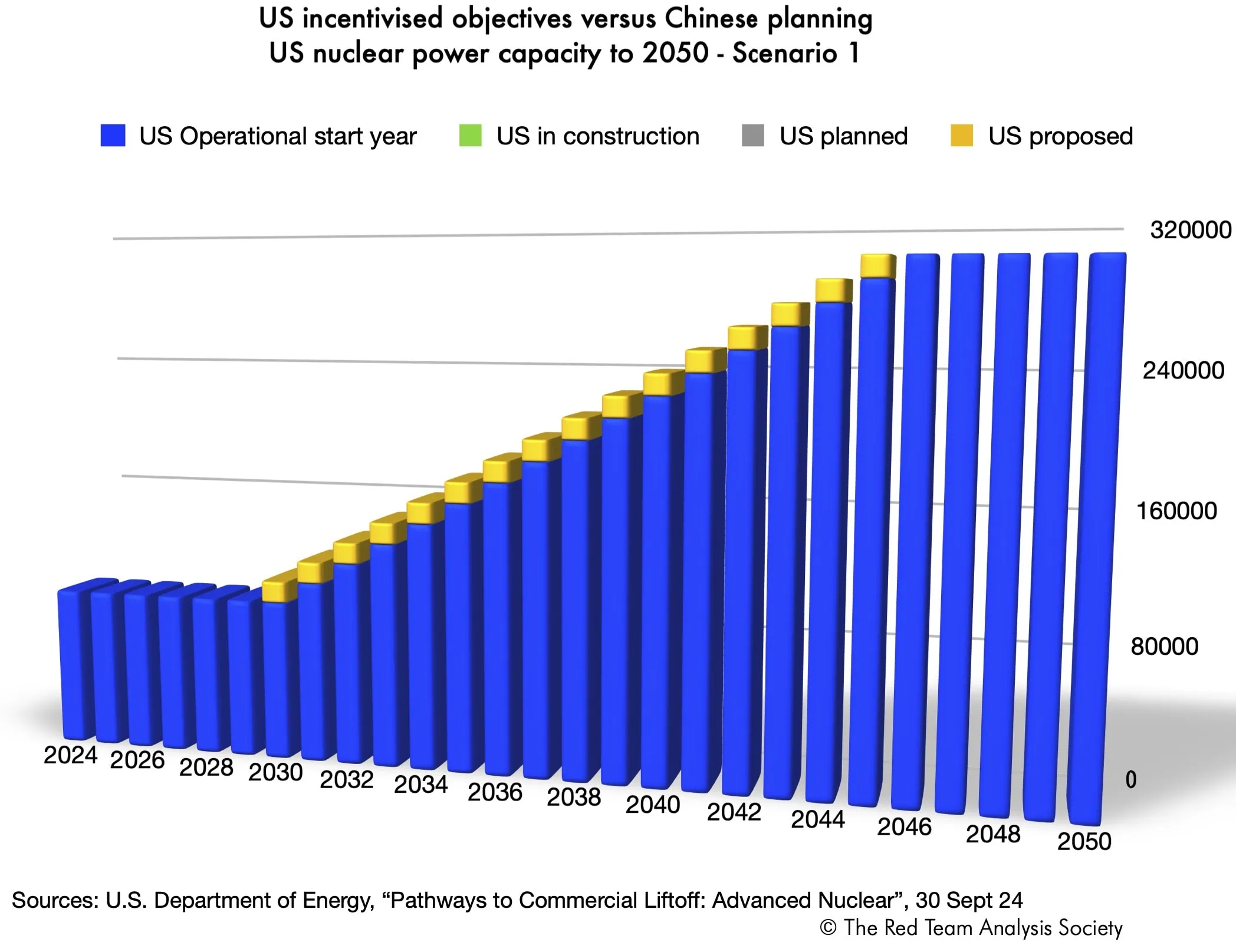

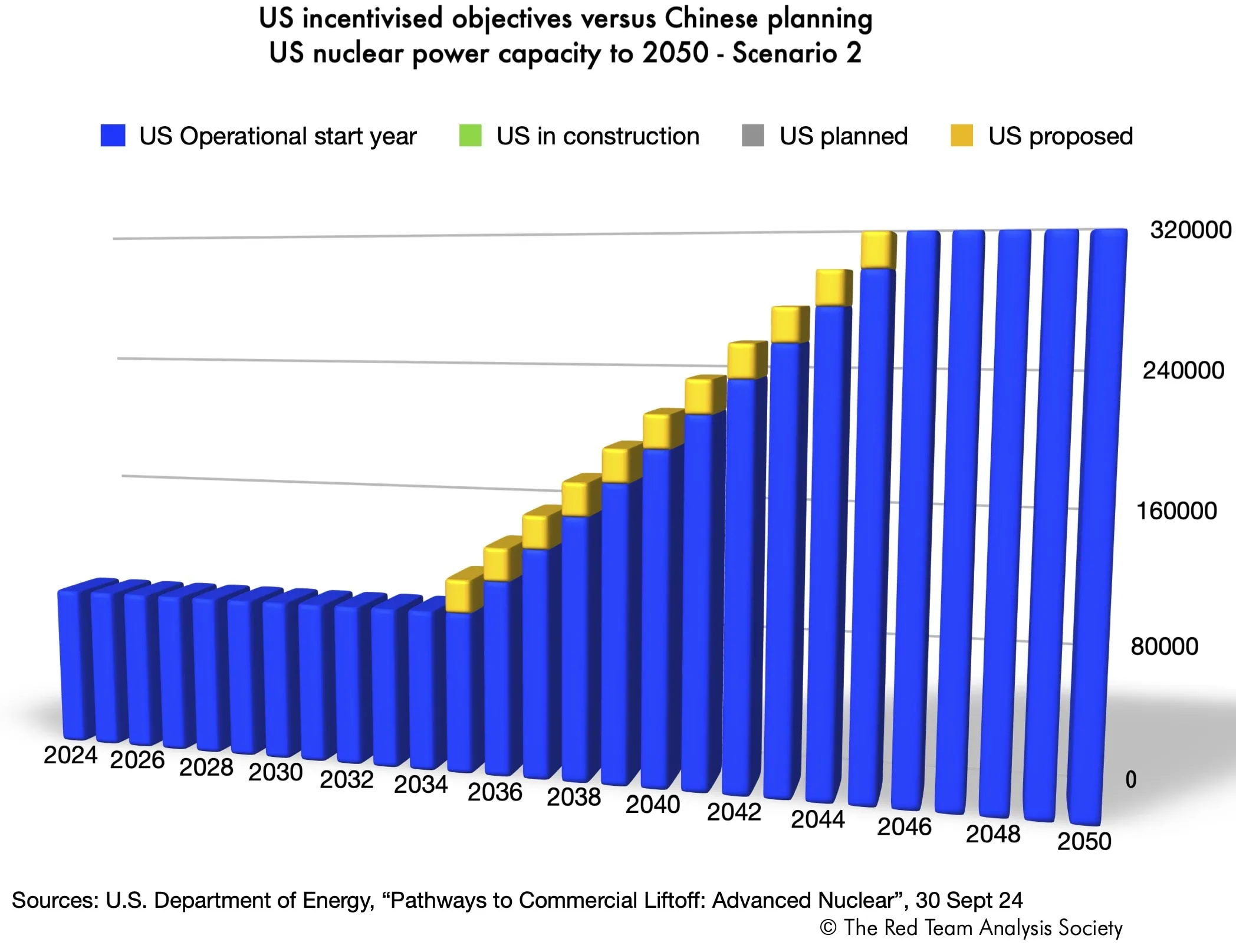

As explained in the DOE report, the U.S. sets objectives, establishes a common normative framework and common knowledge base and then develops incentives that should then incite the private sector to act in such a way that public objectives are met.

If we compare the U.S. approach through “incentive-based objectives” to the Chinese state-led planning, here is what we have in terms of estimates for nuclear energy capacity up to 2050.

In the American case, we have official objectives and yearly targets. However, so far, the reality of nuclear capacity remains quasi unchanged (see also below “An absence of first results when time is short“). The rise in nuclear capacity observed stems solely from the objectives. The level of uncertainty is high.

On the contrary, in the Chinese case, nuclear units being already in construction, it is almost certain that in 2030 China will have caught up with the U.S or be about to do so.

Furthermore, uncertainty is heightened in the U.S. case, because many challenges will need to be overcome.

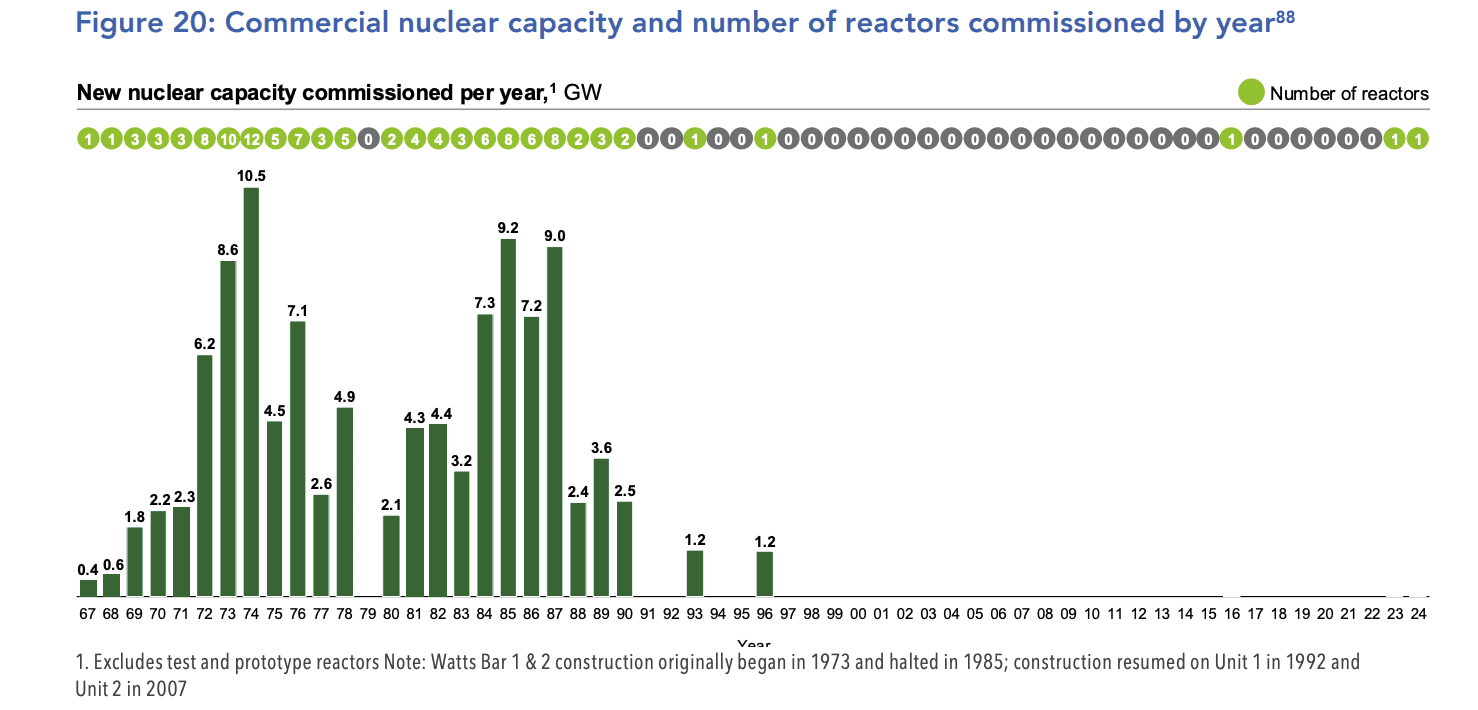

An aged fleet of nuclear reactors

In September 2024, as seen the U.S. has 94 nuclear reactors operating. However, this fleet is old: “Over 90% of the 2024 US nuclear fleet was constructed in the 1970s and 1980s” (DOE, 2024 Pathways to Commercial Liftoff, p.23). The wave of sustained nuclear plants construction and connection to the grid ended in 1990, with only 5 nuclear plants built and connected to the grid since then (Ibid.).

Scenarios 1 and 2 therefore require the licenses of all US nuclear reactors to be renewed when necessary, so that existing reactors can continue to operate. Otherwise, American nuclear power would collapse.

By contrast, the Chinese nuclear fleet is younger. The oldest Chinese reactor, Qinshan 1, saw its construction start in 1985 (WNA, “Nuclear Power in China“, 13 August 2024). It was connected to the grid in 1991 (Ibid.). Two reactors were built at the end of the 1980s and connected during the early 1990s, seven were started at the end of the 1990s and connected during the first decade of the second millenium and all others, i.e. 46, are post-2000s (ibid.).

Furthermore, as the U.S. nuclear reactors’ fleet has aged, this means that the types of nuclear reactors in service also belong to older generations.

Advanced nuclear reactors include Generation III (Gen III), Generation III+ (Gen III+) and Generation IV (Gen IV) reactors (see for example, WNA, “Advanced Nuclear Power Reactors“, April 2021). Advanced nuclear reactors are safer, with a smaller footprint in terms of various materials – as well as space – used and waste produced, more efficient in terms of fuel and operation (Ibid.). They are also meant to have a lower cost of capital (Ibid.).

The Vogtle reactors – Vogtle-3 (1117 MWe) and Vogtle-4 (1117 MWe), the two latest U.S. reactors built, connected to the grid in November 23 and March 24, are Gen III+ reactors. They are the only ones of this kind in the country and the U.S. has no Gen III reactor. By comparison, in China, out of 56 operating reactors (IAEA/PRIS), 14 reactors are Gen III and 2 are Gen III+ (WNA, “Nuclear Power in China“, 13 August 2024). Furthermore, in December 2021, China also connected to the grid the first ever Gen IV small modular reactor.

As a result, in America, the resurrection of reactors that were retired early may help the growth of produced GW, but with a price to pay.

For example, Holtec gets ready to recommission Palisades, which operated for over 40 years and was retired in May 2022 (NRC Preparing to Oversee First of a Kind Effort to Restart a Shuttered Plant). The plant should return to service by the end of 2025, as part of a December 2023 project including two small modular reactors (SMR-300 reactor units) to be operational in mid-2030 (Sonal Patel, “DOE Finalizes $1.52B Palisades Loan for First-Ever U.S. Nuclear Plant Recommissioning“, Power, 30 Sept 2024). In the meantime, worries about this old reactor resurface (Environmentalist Sierra Club, Michigan Chapter, “Reopening the Palisades Nuclear Power Plant Creates Many Risks” May 2024). Furthermore, the process of relaunching a totally stopped reactor is something completely new, which may only heightens worries (e.g. Nicole Pollack, “The murky process of reopening Palisades and why it’s a turning point for nuclear“, Great Lakes Now, 1 May 2024). This runs counter to the peace of mind necessary for the nuclear renaissance, when concerns about safety must have been allayed.

Resurrecting reactors may be done only at the margin, when safety is assured. Considering notably efficiency and safety, reopening old nuclear plants cannot replace building new advanced nuclear reactors.

The difficult construction of few advanced reactors and negative perceptions

U.S. perception of the construction of advanced reactors is informed by the construction and then connection to the grid of the Vogtle Units 3 and 4**, the only two successful available cases.

For these two units,”the original budget was ~$14B, while the final cost was approximately ~$32B” (DOE, 2024 Pathways to Commercial Liftoff, p.47). Vogtle Unit 3 was expected to start in 2016, and Unit 4 shortly afterwards (Nuclear Newswire, “Vogtle-4 startup delayed to Q2“, 5 February 2024). They started respectively in November 2023 and March 2024, thus with a 7 years delay.

Then, perceptions of the construction of Western advanced nuclear reactor may not ignore the EPR (initially European pressurized reactor, renamed Evolutionary power reactor) experiences.

France’s Gen III+ EPR at Flamanville (1600 MWe) was 12 years delayed (17 years instead of 54 months, i.e. 4.5 years, planned, construction started in December 2007). The initial cost was 3.3bn €, but finally amounted to 13.3bn € (Anthony Raimbault, “EPR de Flamanville : retour sur les nombreux déboires d’un interminable chantier“, France Bleu, 8 May 2024). The Olkiluoto-3 EPR in Finland was 13 years delayed and to the initial € 3.3 bn budget were added € 10 bn (Jean-Michel Bezat, “Nucléaire : l’Etat français aide Areva à solder le passif de l’EPR finlandais“, Le Monde, 8 juillet 2021). By contrast the two EPRs (Taishan 1 and 2) built in China also met delays, but only 8 years were needed between the start of the construction and first grid connection (WNA, “Nuclear Power in China“, 13 August 2024).

For the EPR, the final cost per MW (8.3 M € per MW) remains lower than for Vogtle units (14.3 M US$), but it is nonetheless higher than what was initially budgeted.

Hence, the perceptions of the construction of Gen III and Gen III+ nuclear plants for Americans and more largely Western actors, those that will also be involved into financing the American Nuclear Renaissance, include the risks of long delays and enormous budgetary drifts.

Because very few reactors were constructed, even though the analysis of the problems has been done, the solutions proposed have not been experimented. As a result, it cannot be demonstrated that the risks have truly been mitigated. For example, the DOE 2024 Pathways to Commercial Liftoff studies at length the difficulties met by Vogtle 3 and 4 and out of this understanding makes recommendations. Yet, so far, these remain recommendations on paper.

Investors and constructors must be convinced that these strategies and recommendations are the right one and sufficient to lead to shorter construction and deployment time and to the respect of initial cost.

Furthermore, because few advanced reactors were built, the full ecosystem that goes with the development of a thriving industrial activity, from workforce, to subcontractor, from foundry to the myriad of skills and competencies involved in the construction of advanced nuclear reactors, could not fully emerge and expand (DOE, 2024 Pathways to Commercial Liftoff, pp. 55-56). This could create unforeseen chokepoints and challenges that only increase uncertainty and the perception of a high-risk activity.

The quest for a new financing model

Considering the perceived high-risk and the heavy investment needs, the American and international private sector so far appears as hesitating.

This reluctance was highlighted in a Financial Times article reporting notably on bankers’ and Big Tech chief scientist officers’ and heads of energy’s discussions (Malcolm Moore and Lee Harris, “Is nuclear energy the zero-carbon answer to powering AI?“, 3 October 2024). For the interviewees, the main factors that could trigger the launch of the construction of nuclear plants were now positive – i.e. government commitments, financial commitments to support new nuclear construction, and demand for nuclear energy. Yet, so far, no one wants to put capital into the activity because of the high-risk perception in terms of years delay and billions over budget (Ibid.).

Within the American private-sector orientated paradigm, actors, including the U.S. state, will have to find a new model for financing nuclear energy and building new reactors if the targets are to be met. The new consortium-like approaches suggested by DOE, besides the array of various incentives in favour of nuclear energy, including loans, programs or tax credits, added to more authoritative actions directed abroad such as sanctions against Russia, could be a way forward or an element of the new model (DOE, 2024 Pathways to Commercial Liftoff, pp.40 and following).

Considering the very long timeline for everything related to nuclear power, if this new approach is not found, or is not efficient enough, then the third scenario or a variation on it may still take place. It is obvious that it is in the interest of the U.S. and of its companies not to see that happening. However, short-termism and the financialization of activities, alongside a quest for rapid growth and profits, may also be too powerful to favour the wise long-term investments, which are at the heart of the nuclear field (e.g. Thomas I. Palley, “Financialization: What It Is and Why It Matters“, Levy Economics Institute, Working Paper 525, 2007).

An absence of first results when time is short

Given the challenges involved, so far, most of the announcements made, such as the agreement between Microsoft and Constellation, have mainly concerned the purchase of energy, rather than the construction of nuclear reactors. Furthermore, they concerned old reactors and not new advanced ones.

Yet, to see the advanced nuclear “commercial liftoff in the US” taking place according to scenario 1, “first orders would need to be placed by ~2025” (DOE, 2024 Pathways to Commercial Liftoff, p.40).

As of 30 September 2024, there is no such order, i.e. “signed contracts, to construct new nuclear reactors in the US” (Ibid.). Only expressions of interests have been registered (Ibid.). Meanwhile, according to the counts of the World Nuclear Association, 13 reactors are being proposed, for a capacity of 0.11 GWe (WNA, “World Nuclear Power Reactors & Uranium Requirements“, 1st October 2024).

The year 2025 will be decisive.

A battle of ideologies

The capacity of the U.S. to see a new model for nuclear energy emerge could have tremendous impact beyond the nuclear field, .

Indeed, as seen above, the American nuclear energy renaissance is also enmeshed with the American National Security Strategy as it seeks to ensure the U.S. international order prevails over the Sino-Russian one. Thus, if the American model proved incapable of achieving the U.S. nuclear renaissance, then not only would the U.S. fail to meet its various objectives, and to remain the world primary player in nuclear energy, but the very ideological model it champions would be questioned. In addition, the U.S. would have to face cascading consequences for energy-intensive American technological development, for example in the field of artificial intelligence with effects on the military, which, in turn, would also negatively impact American influence in the world.

The challenge here is collective and involves the whole of American society. As the world tends to become bipolar again, it will also impact the U.S. allies.

The U.S. nuclear renaissance is thus at once key and challenging in many ways. It faces many hurdles such as an aged fleet of reactors and little experience of nuclear plant construction over the last decades. Meanwhile, the U.S. “incentive-based approach” as public policy model adapted to nuclear energy and to the scale of the effort envisioned has yet to prove itself.

Yet, American needs and objectives are formidable, as, according to DOE, the U.S. must build and connect to the grid twice as much nuclear capacity by 2050, i.e. in 25 years, than what it succeeded doing between 1965 and 2024 (shutdown capacity not taken into account), i.e. in almost 60 years.

Will power and creativity must never be underestimated, especially when intertwined with national and international security. It will be essential to watch closely what happens in the US nuclear energy sector over the next few years, and in particular over the next twelve months, as these will be critical.

Now, to these formidable tasks must be added another key element, the capacity to fuel the future fleet of reactors. The next article will focus on the uranium requirements of the U.S. nuclear renaissance.

Notes

*Compared with the article “The Future of Uranium Demand – China’s Surge“, here, we changed our way to estimate China’s future nuclear capacity. Notably we introduced estimated dates for the start of construction of reactors and the connection to the grid for the planned and proposed nuclear reactors.

**The Vogtle Units 3 and 4 are owned by Georgia Power (45.7%), Oglethorpe Power Corporation (30%), Municipal Electric Authority of Georgia (22.7%) and Dalton Utilities (1.6%).

Leave a comment