(Art direction and design: Jean-Dominique Lavoix-Carli)

A new era starts for nuclear energy.

The December 2023 “Declaration to Triple Nuclear Energy by 2050”, signed by 22 states, officially cemented the beginning of the renewal of nuclear energy (see Helene Lavoix, “The Return of Nuclear Energy“, The Red Team Analysis Society, 26 March 2024). Then, on 21 March 2024, 33 governments and international agencies reasserted their commitment with the first Nuclear Energy Summit. The nuclear industry endorsed the two declarations and their objectives.

- Niger: a New Severe Threat for the Future of France’s Nuclear Energy?

- Revisiting Uranium Supply Security (1)

- The Future of Uranium Demand – China’s Surge

- Uranium and the Renewal of Nuclear Energy

- AI at War (1) – Ukraine

- Anticipate and Get Ready for the Future – Podcast

- The Return of Nuclear Energy

However, as we started outlining previously with a case study focused on the Franco-Mongolian deal (Ibid.), this new era will also come with new geopolitical challenges and tensions, as states seek to reduce the potential for insecurity linked to nuclear energy.

This article continues exploring what the renewal of nuclear energy entails for the future. First, we highlight the need to look at the whole nuclear fuel cycle, while stressing that anticipation and long-term planning are key, if we want to succeed in trebling nuclear energy by 2050. Second, starting with the beginning of the cycle, mining and milling uranium, we focus on the various types of uranium reserves and evaluate their availability considering objectives.

Finally, we move from reserves to uranium production and highlight a growing risk of undersupply, considering potential future demand, that will need to be overcome. This coming quest for uranium security will be intertwined with political and geopolitical issues, while itself becoming a geopolitical stake, in an escalating feedback loop.

The nuclear fuel cycle and long-term planning

A very large part of the world is thus committed to try trebling nuclear power generation by 2050, i.e. in 26 years.

This implies meeting many challenges, which go beyond the fundamental, but not sufficient, “cost, performance, safety and waste management” efforts highlighted by international agencies (International Energy Agency – IEA, Nuclear Power and Secure Energy Transitions, 2022; Nuclear Energy Agency – NEA, Meeting Climate Change Targets: The Role of Nuclear Energy, OECD Publishing, 2022, Paris, pp.39-46).

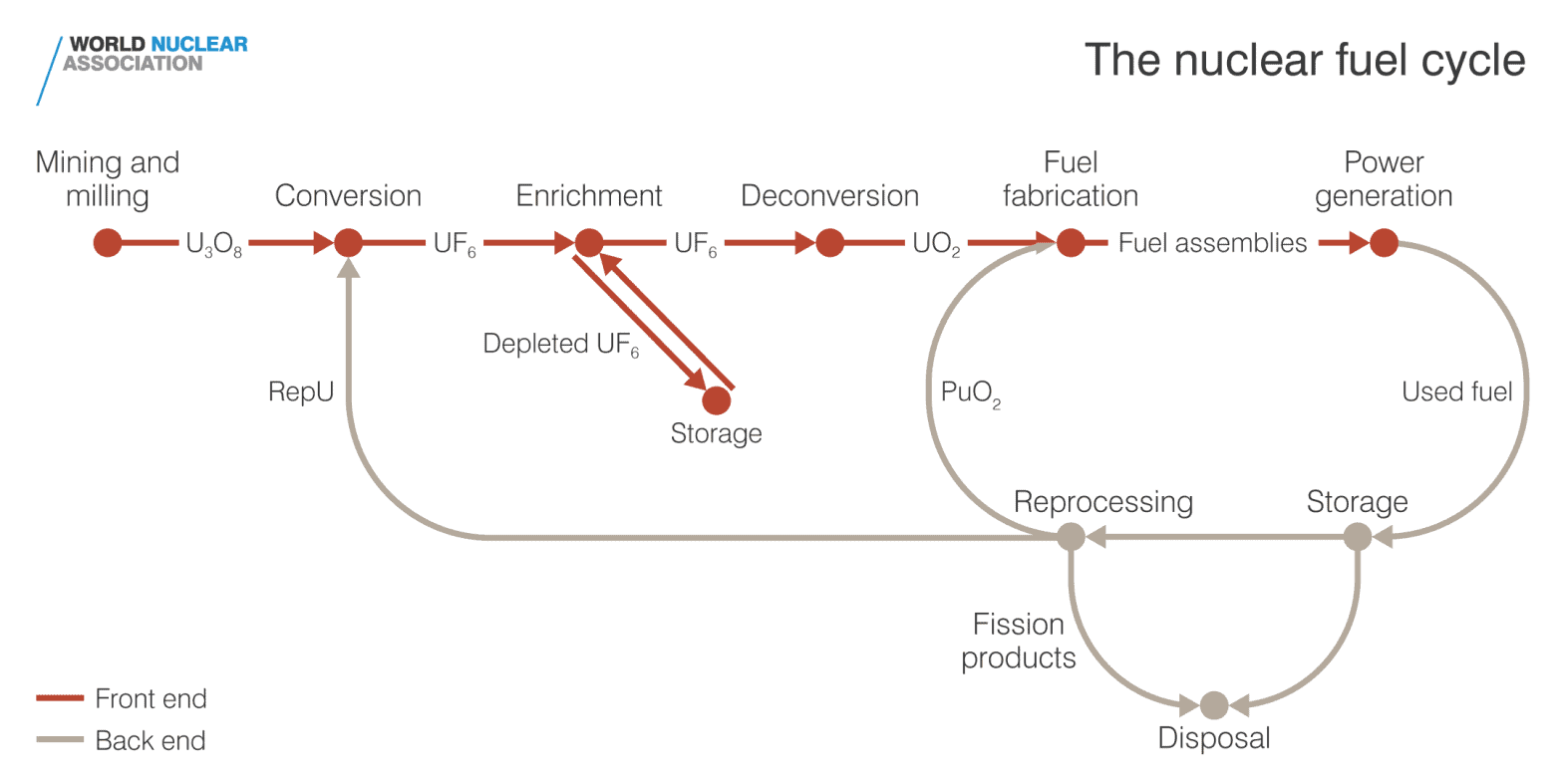

Actually, if we want to understand what it means to treble the nuclear energy capacity, then we need to look at what is called the nuclear energy or nuclear fuel cycle (see diagram below). Trebling our capacity to produce nuclear energy does not only mean “simply” trebling the energy generated by nuclear plants. It will also demand that the whole nuclear cycle allows for this major increase.

Each step will bring its own challenges (for a detailed explanation of the industrial process, read “Nuclear Fuel Cycle – Overview” – World Nuclear Association – April 2021).

The issue is even more complex as changes taking place at one step of the process will reverberate on other steps. For example, projects that include recycling nuclear fuel as well as operate in a fully closed fuel cycle, for instance fast neutron reactors, could alter the fuel cycle by lowering the need for uranium (e.g. Lucy Ashton, “When nuclear waste is an asset, not a burden“, IAEA, September 2023; Orano, “Traitement & recyclage des combustibles usés : ce qu’il faut retenir“).

Furthermore, changes at each step, including building a new nuclear plant -apart for Small Modular Reactors (SMR) – for example, belong to the long term.

For instance, China’s Shidaowan high temperature gas-cooled reactor (HTGR) nuclear power plant, the world first generation-IV nuclear power plant, went officially into commercial operations in December 2023. Its construction started in 2012 and it began generating power in December 2021 (Xinhua, “World’s 1st 4th-generation nuclear power plant goes into commercial operation in China“, Global Times, 7 December 2023). It therefore took 12 years from the start of construction to final launch. The timeline is even longer if we consider research and development, as, for example, for Generation-IV reactors “several innovative concepts … have been under development for decades” (NEA, Meeting Climate Change Targets, p.28).

Note that a new timeline will be created as the Small Modular Reactors (SMR) multiply, as wished by governments (e.g. Nathan Canas et Paul Messad, “La Commission vise la construction d’un premier petit réacteur nucléaire en Europe «d’ici 2030»“, Euractiv, 7 Feb 2024; forthcoming IAEA International Conference on Small Modular Reactors and their Applications, 21–25 October 2024, Vienna, Austria). Indeed SMRs are meant to be built in 2 to 3 years – 40 months, i.e. 3,33 years, for example for the French EDF NUWARD (e.g. Nathalie Mayer, “Comment ce mini réacteur nucléaire SMR va décarboner l’Amérique du Nord“, Révolution Energétique, 1 Feb 2023). However this shorter timeframe will demand even more long-term anticipation for the operators of the remaining part of the fuel cycle as timeframes will conflict.

Hence, possible futures for each step will need to be foreseen, while impacts on every other step for each scenario will have to be evaluated.

Anticipation and long-term planning are of the essence for the nuclear industry.

For instance, over the last decades, a focus on a temporarily depressed nuclear market, the absence of consideration of geopolitical security stakes, short-termism and financialization, added to adverse public opinion and lack of political courage among others, all favouring an inability to anticipate and thus plan ahead, have increasingly plagued many countries and led them to fall in terms of nuclear energy behind other states with a less myopic worldview (e.g. in the case of France, Assemblée nationale, Rapport de la commission d’enquête visant à établir les raisons de la perte de souveraineté et d’indépendance énergétique de la France, 30 mars 2023, pp. 20-26, 268-309).

For example, the IEA highlights that “investment in nuclear power in advanced economies has stalled over the last two decades”(Nuclear Power and Secure Energy Transitions, June 2022, p.16). Now these countries will have to catch up.

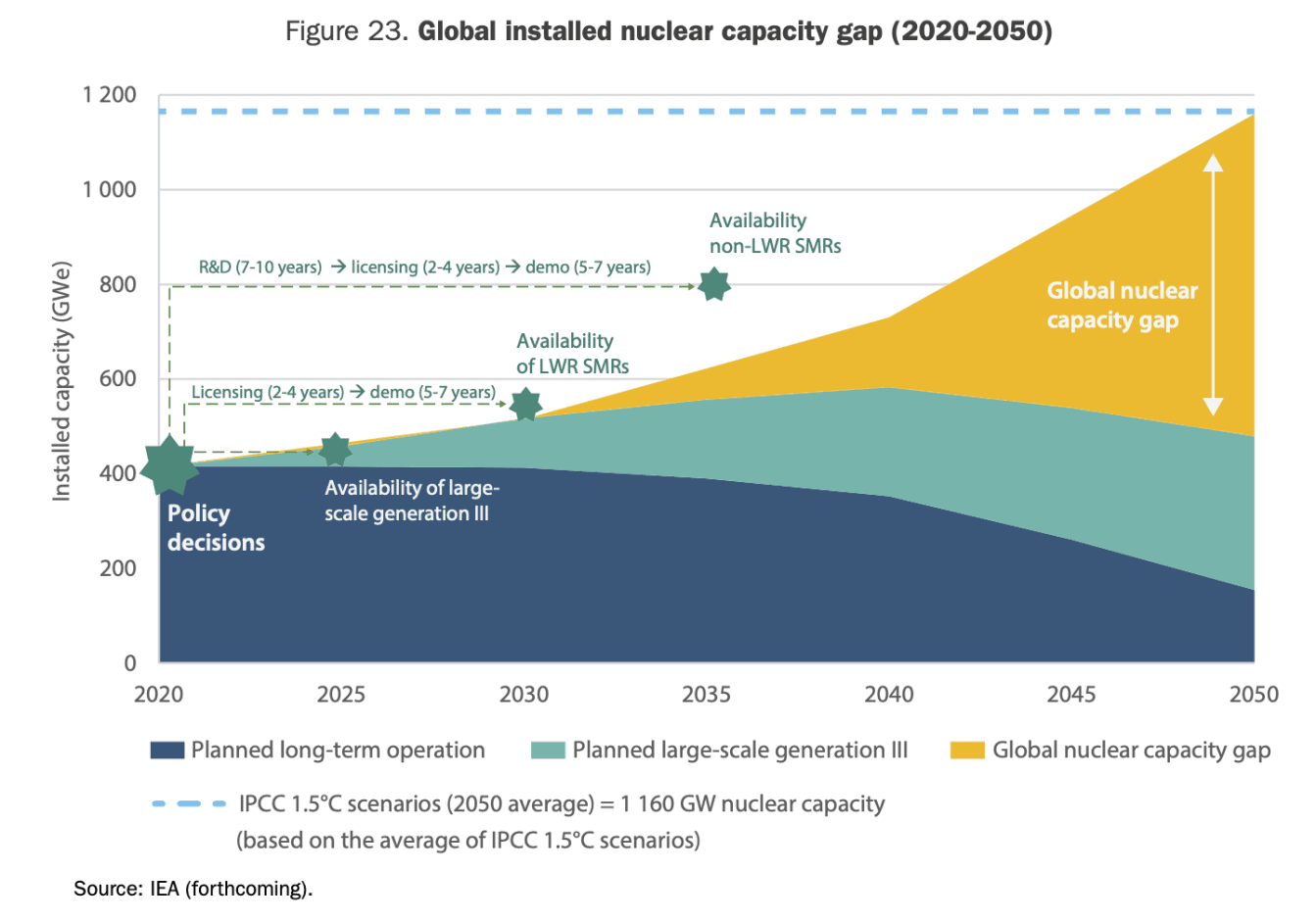

Globally, as a result, to reach the new objectives for the nuclear energy capacity, the world must now overcome a “global installed nuclear capacity gap (2020-2050)” (NEA, Meeting Climate Change Targets…, p.39).

This example highlights how dangerous the absence of long-term vision is and how difficult to overcome it is in the case of nuclear energy.

Furthermore, however huge the task the NEA highlights, this gap is “only” about the “power generation” phase of the cycle (Ibid. pp. 38-39).

Power generation is indeed critical as it is the driver for the whole chain of processes.

We thus need to pay heed to the recommandations the IEA and the NEA crafted to allow the nuclear to play its full role in achieving net zero by 2050 (IEA) by trebling nuclear power production by 2050 (NEA):

NEA, Meeting Climate Change Targets…, pp.39-46 and IEA, Nuclear Power and Secure Energy Transitions, p. 12.

- Acting now (NEA)

- Understanding and reducing costs (NEA) and Make electricity markets value dispatchable low emissions capacity (IEA)

- Improving deployment timelines (NEA)

- Accelerate the development and deployment of small modular reactors (IEA)

- Extend plant lifetimes (IEA)

- Financing and investing, with “the right policy frameworks” (NEA) and Create financing frameworks to support new reactors (IEA)

- Make long-term support [by governments] contingent on the industry delivering safe projects on time and on budget (IEA)

- Building public confidence (NEA)

- Promote efficient and effective safety regulation (IEA)

- Implement solutions for nuclear waste disposal (notably involving citizens) (IEA)

- Breaking the silence on nuclear energy, ensuring full representation in policy discussions about clean energy and climate change (NEA)

Yet, we must also consider the remaining part of the nuclear fuel cycle to avoid disappointments and unintended consequences, bearing in mind the importance of feedback loops between the different steps of the nuclear fuel cycle, of timelines and obviously of anticipation, without forgetting the political and geopolitical context and stakes.

We focus here on the first part of the cycle, uranium mining and milling, seen from a geopolitical and international security perspective.

Uranium reserves

If nuclear energy must triple by 2050, then the supply of fuel, i.e. uranium, needed for the plants must also increase. The first question is thus to know if there is enough uranium available to meet this objective. We must thus look at uranium reserves.

According to the international official reference estimates, the “Red Book”, a joint publication of the NEA and International Atomic Energy Agency (IAEA), there is sufficient uranium to meet current and long term needs, including those implied by new developments:

“Identified recoverable resources, including reasonably assured resources and inferred resources (at a cost <USD 260/kgU, equivalent to USD 100/lb U3O8) are sufficient for more than 130 years, considering the uranium requirements 0f the year 2020.”

NEA/IAEA Uranium 2022: Resources, Production and Demand (Red Book), pp. 14-15.

The previous edition of the “Red Book” (published every two years) estimated that uranium recoverable resources (at a cost <USD 260/kgU, equivalent to USD 100/lb U3O8) were sufficient for over 135 years for the uranium requirements of 2019 (NEA/IAEA Uranium 2020: Resources, Production and Demand ). The decrease from 2020 to 2022 stemmed from “mine depletions, …downgrading of resources, …reassessment of recoverability factors” (NEA/IAEA Uranium 2022, pp.19-20).

Let us look more in detail at the estimates of uranium supply for future needs, considering current political and industrial willingness to triple nuclear capacity by 2050.

First we shall assess estimates of uranium requirements considering objectives, then we shall look at the reserves of uranium given these estimated future uranium requirements.

Having been published before the plans to triple nuclear energy by 2050, the “Red Book” estimated in 2022 that a high demand case would correspond to a nuclear net generating capacity of 677 GWe in 2040, i.e. an increase of around 70% compared with 2020 capacity (NEA/IAEA, Uranium 2022, p. 12). The “Red Book” estimated in that case that “world annual reactor-related uranium requirements (excluding the use of mixed oxide fuels, which is marginal)” are “projected to rise to 108.200 tU/y by 2040” (Ibid. – note that here, ideally, different scenarios should be made according to variations for each step of the cycle, for example the different types of generators that will be built. In the framework of this article we shall rely on the NEA/IAEA estimates).

The NEA, for its part estimated that “the average IPCC 1.5°C scenario requires nuclear energy to reach 1.160 GWe (gigawatts electrical) by 2050 (NEA, Meeting Climate Change Targets, p. 33). We know that the 2021 net energy generating capacity was of 393 GWe (Gigawatt electrical) requiring about 60.100 tU/y (tonnes of uranium per year) (NEA/IAEA, Uranium 2022, p. 12). Thus the new target corresponds to almost tripling the current world nuclear capacity by 2050. It was the objective endorsed by twenty two countries and the nuclear industry at the COP 28 in December 2023 (see Lavoix, “The Return of Nuclear Energy“). It is thus this objective and not the “high demand case” scenario of the 2022 “Red Book” that we must consider and for which we need to evaluate uranium requirements.

If we use the ratio of uranium related requirements per GWe of the 2022 “Red Book”, and the yearly progression in capacity of the IEA Net Zero by 2050 revised for the World Outlook 2023, and apply them to the officially endorsed objectives of the NEA, we obtain the following table for the yearly needs in tU/y.

| Scenarios | 2022 | 2030 | 2035 | 2040 | 2050 |

| Nuclear Capacity – Red Book 2022 | 677 GWe | ||||

| Reactor-related uranium requirement | 108 200 tU/y | ||||

| Nuclear produced energy (NEA scenario) | 4 984 TWh | 6 271 TWh | 7 070 TWh | 7 617 TWh | |

| Nuclear Capacity (NEA scenario) | 685 GWe | 871 GWe | 1 030 GWe | 1 160 GWe | |

| Estimated reactor-related uranium requirement tU/y (calculated) | 49.355 tU/y | 109.496 tU/y | 139.248 tU/y | 164.548 tU/y | 185.394 tU/y |

Now, in the next table, we estimate the reserves of uranium available, starting from the figures given in the 2022 Red Book.

Available resources vary according to price – the higher the price, the more reserve available. Thus, to be able to estimate the reserves of uranium available for the increase in nuclear capacities, we need first to assess the future price of uranium.

The price range used is as follows:

| / KgU | <US$ 40,00 | <US$ 80,00 | <US$ 130,00 | <US$ 260,00 |

| /lbs U3O8 | <US$ 15,00 | <US$ 30,00 | <US$ 50,00 | <US$ 100,00 |

In January 2024, for the first time since April-July 2007, spot uranium prices rose above USD 100,00/lbs U3O8. Long term price traded at USD 72. On 29 February, a pound of U3O8 traded USD 95 on the spot market and long term contract traded USD 75 (Cameco using month-end prices by UxC and TradeTech ). On 31 March 2024, a pound of U3O8 traded USD 87,75 , the the long-term contract traded USD 77,5.

We see a slight decrease over the last three months for spot prices, bt these prices concern only “15% to 25% of all annual uranium transactions” (NEA/IAEA, Uranium 2022, p.128). On the other hand, long-term contracts are steadily rising. Furthermore, for both spot and long term contracts, prices have risen over the last five years. Finally and most importantly we must take into account the officially planned development of nuclear capabilities. Thus, in market conditions, it is very likely that long-term prices will rise above USD 100/lbs U3O8 as the trebling objective starts truly being implemented. We make here the hypothesis that this will be true from 2030 onwards.

If ever the imperatives of energy production were high enough in terms of national security, un the future, uranium could become a nationalised resource. Then market price would become irrelevant. In that case, the reserves at the highest cost would most likely represent a reality in terms of quantity.

As a result, we consider here reserves available at the highest cost, i.e. USD 260/kgU, equivalent to USD 100/lbs U3O8.

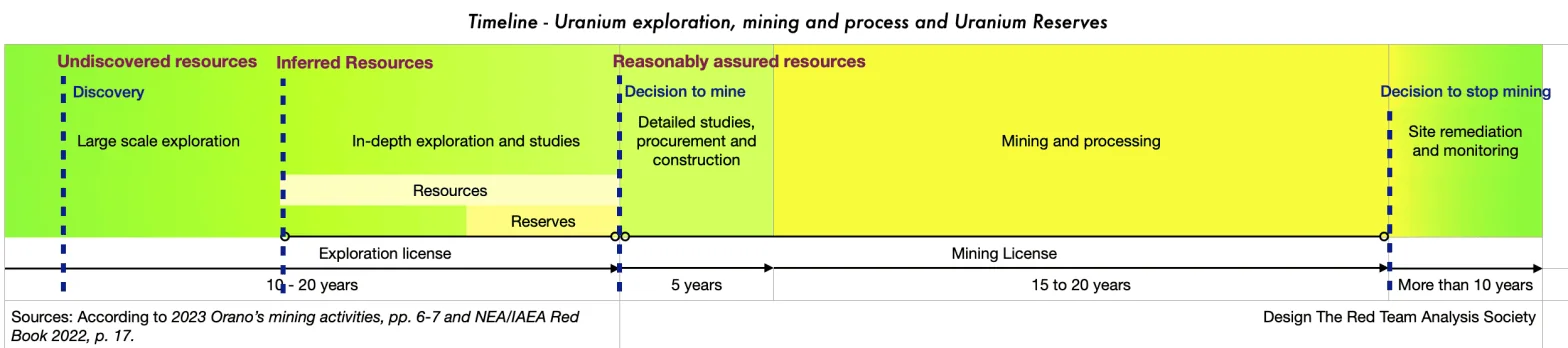

We take into account the various types of resources as categorised in the Red Book: “Identified recoverable resources, including reasonably assured resources” [corresponding approximately to decisions to mine] “and inferred resources” [corresponding to decisions to carry out in-depth studies], and finally “undiscovered resources” [expected to exist based on geological knowledge] (NEA/IAEA, Uranium 2022, p. 17) . The various types of reserves and the stages of uranium exploration, mining and process are portrayed on the timeline below.

We obtain the following table with years of remaining resources. For example, the production used to calculate the number of years of uranium left for the year 2035 is the production of 2035.

| 2021 (Red Book 2022) | 2022 | 2030 | 2035 | 2040 | 2050 | |

| Estimated reactor-related uranium requirement tU/y | 49 355 | 109 496 | 139 248 | 164 548 | 185 394 | |

| Identified recoverable resources (IRR) tU | 7.917.500 | 7.868.145 | 7.423.950 | 6.766.974 | 5.931.485 | 4.121.461 |

| Number of years of sufficient IRR | 130 | 159 | 68 | 49 | 36 | 22 |

| RAR tU | 4.688.300 | 4.638.945 | 4.194.750 | 3.537.774 | 2.702.285 | 892.261 |

| Number of years of sufficient RAR | 94 | 38 | 25 | 16 | 5 | |

| Inferred Ressources tU | 3.229.200 | 3.229.200 | 3.229.200 | 3.229.200 | 3.229.200 | 3.229.200 |

| Number of years of sufficient IR | 65 | 29 | 23 | 20 | 17 | |

| Undiscovered resources tU | 5.703.460 | 5.703.460 | 5.703.460 | 5.703.460 | 5.703.460 | 5.703.460 |

| Number of years of sufficient UR | 116 | 52 | 41 | 35 | 31 |

at a cost <USD 130/kgU, equivalent to USD 50/lbs U3O8. The figures for this decade would be lower but nonetheless globally sufficient (IRR = 6.029.145 in 2022; RAR 3.814.500) – For the estimated identified recoverable resources, no new discovery was added, the estimated reserves given in the Red Book 2022 were diminished by the estimated uranium required for the period. The years of “reserve” correspond to an estimated uranium requirement for the year of the column.

According to the table above, assuming the intermediary objectives until 2050 are reached, then, indeed, up until 2050 there is enough reserve of uranium of the “reasonably assured resources” type. However, in 2050, there will only be 5 years left of this type, 17 years of the type “inferred resources” and 31 years of the type “undiscovered resources”.

Meanwhile, the map of identified recoverable conventional uranium resources – RAR + Inferred R (for a lower price, i.e. <US$ 50,00/lbs U3O8 or <US$ 130,00/kgU), as drawn by the NEA/IAEA is as follows:

Even though the NEA/IAEA highlights the “widespread” distribution of uranium resources, the map let us anticipate uranium will be increasingly part of future geopolitical stakes.

For now, considering estimated available uranium resources, the question is not so much to know if there are enough reserves globally in the world, but if current and planned uranium production is sufficient to meet the rise of nuclear capacities or, alternatively if the production can increase quickly enough to meet that increase.

Increasing uranium production to meet objectives

What is the status of potential uranium production?

The NEA/IAEA estimates production capability, using a mix of countries’ projections of production capability from 2025 through 2040 with their own evaluations when a country did not communicate information (for the whole paragraph, NEA/IAEA, Uranium 2022, pp.89-91). They use two metrics. First, we have the most certain uranium production projection, i.e. those resulting from “existing and committed production centres”, labelled A-II. Then, we have larger but less certain production projections, i.e. those stemming from “existing, committed, planned and prospective production centres”, labelled B-II. B-II thus includes A-II. The results are reproduced in the first line of the next table.

We then compare these estimates to the uranium requirement to reach the trebling goal we calculated earlier and estimate as a result if the world produces or not enough uranium.

en tU/y | 2025 | 2030 | 2035 | 2040 | 2050 | ||||

| A-II | B-II | A-II | B-II | A-II | B-II | A-II | B-II | ||

| Total projected production (NEA/IAEA) | 69675 | 83 105 | 67 105 | 107 850 | 55 095 | 104 480 | 49 475 | 98 250 | ? |

| Estimated reactor-related uranium requirement (RTAS) | 109 496 | 139 248 | 164 548 | 185 394 | |||||

| Possible yearly Uranium deficit | -42 391 | -1 646 | -84 153 | -34 768 | -115 073 | -66 298 | ? |

The estimates are made for a price inferior to USD 130/KgU (i.e. less than USD 50/lbs U3O8), knowing that, in 2024, we are above those prices, as seen. Indeed, as for reserves, the lower the price the more likely mines or part of them will be closed, hence a lowered production. Reversely, the higher the price, the more likely a mine will produce at full capacity. Considering the rising price for uranium, which is likely to be sustained as we treble nuclear capacities, it is possible that the potential for uranium production to 2040 be higher. The supplementary possible production is however impossible to evaluate without further detailed information per mine. We can expect that the next edition of the “Red Book” will include these projections.

For now, considering the large undersupply of uranium for each milestone year of the scenario – up for 2040 almost 1,5 times the 2022 production, assuming each year we manage to catch up with the previous year’s deficit, it is obvious that a major effort must be made in terms of development of mines and processing capabilities.

We thus meet a global problem: to increase in a timely manner uranium production.

The fatality of geography for uranium production

Then, in 2020 and 2021, uranium was produced only in 17 countries “with total global production amounting to 47 342 tU in 2020 and 47 472 tU in 2021” (NEA/IAEA, Uranium 2022, p. 116). In 2022, the World Nuclear Association estimated that the world production reached 49.355 tU (“World Uranium Mining Production“, Updated August 2023).

Only six countries (Kazakhstan, Namibia, Canada, Australia, Uzbekistan and Russia) accounted for 88% of the production and 10 countries (the former plus Niger, China, India and Ukraine) for 99% (NEA/IAEA, Uranium 2022).

Thus, as for the reserves, the projected production is unequally shared among countries as the four interactive maps below show. A large part of Africa, Central America, Europe, the Near East, South East Asia and some parts of South America have no or hardly any production.

Uranium projected production in tU/y

(Data from Table 1.23. World production capability to 2040, estimates B-II in Uranium 2022: Resources, Production and Demand, p. 90)

2025

2030

2035

2040

Again, this unequal spread of production let us expect future geopolitical competition for uranium production.

Increasing uranium production, timeliness and geopolitics

Being able to have enough uranium in the future when needed will greatly depend, on the one hand, upon the demand, of course, and, on the other, upon the production capacity of the mines being currently exploited, of their remaining lifespan, as well as on the status of current exploration, added to the delay existing between successful exploration and full capacity production in terms of mining and milling. And here, for now, we make abstraction of the remaining part of the nuclear cycle as well as of transportation.

For example, as shown in the timeline below, according to Orano, one of the leading international groups in the nuclear energy sector, between 15 and 25 years are needed between the discovery of a potentially useful deposit of uranium and the start of mining and milling operations (pp. 6-7), assuming there is no unforeseen event of a geopolitical type for instance. Then, a mine will be exploited for 15 to 20 years, followed by a period of 10 years and more to remediate the mining and milling site, possibly converting it, while constantly monitoring it (Ibid.).

2023 Orano’s mining activities, pp. 6-7 with approximately corresponding reserves as explained in NEA/IAEA Uranium 2022, p. 17. (Back to reserves.)

In other terms, assuming we need to add to our resources some totally new uranium site, the discovery of an uranium site taking place at the start of 2024 would correspond to a production starting between 2039 and 2049. Hence if we want to be able to treble our energy production by 2050, all necessary supplementary discoveries of sites must have taken place by 2025 if we want to be absolutely certain to produce enough uranium for 2050.

We know from our analysis of uranium reserves that globally we may use mainly RAR reserves to increase the supply of uranium. We may thus, again globally, focus on these RAR reserves.

In that case, because 5 years are needed between the “decision to mine” and the actual production of a mine, then we shall need to make sure that all “feasibility studies and decisions to mine” are taken 5 years before the need for uranium occurs. It means that to meet 2030 objectives, all “decisions to mine” will need to have been firmly taken by 2025. Not only “planned and prospective production centres” will need to be fully operational, but some further 1646 t will have to be produced from somewhere, either from existing sites where production capabilities will be increased, or from new mines included within the RAR reserves. The challenge will increase each year, with new “decisions to mine” having been taken by 2030 for, at best, 34 768 tU/y.

Practically, the “decisions to mine” translate into having mining permits with the country where the mine is located, then making the last studies and then constructing the industrial facilities, if needed.

Thus, by 2030, globally, the producing mines and milling capacities will need to represent 2,82 times those of 2022.

Obviously, here geopolitics will play an important role as sour relations with a country, competitive or adverse external influence may derail any project. Similarly the security situation within a country will also be key as instability up to civil war, organised crime, terrorist and guerrillas activities will have the power to question mining permits – for example in the case of a coup – or to strongly hinder if not stop the completion of final surveys and the construction of industrial facilities. Obviously, the challenges will continue throughout the production period.

These difficulties are not new but as instability spreads in the world and as international tensions heightens, then the political and geopolitical risks to uranium production will increase. Furthermore, because of the trebling objective for nuclear energy, the stakes linked to uranium production will be higher. As a result, the threats to uranium production will intensify.

Thus, if, globally, we know that we have enough RAR reserves, and it seems we need not worry about availability of supply, this security is partly an illusion.

Apart in statistics, in the real world there is no such thing as globally available uranium resources where each company and country can take anytime whatever amount of supply it needs. Geological surveys, industrial logic, timeline and competition, domestic instability, national interest and international tensions, all taking place under the rising stress brought about by climate change must imperatively be taken into account.

Furthermore, as highlighted above, the shorter timeline between the start of a SMR and its completion may create new challenges for the whole industry as 2 to 3,5 years (the time to build a SMR) is far below the 5 years necessary between the decision to mine is taken and the start of production.

The real question is thus to rise uranium production according to the trebling objectives in a way that allows each nuclear plant, whatever its type, to function and produce energy, while considering resources, mining and milling timeline and process alongside domestic security situation, national interest and geopolitics, while climatic conditions change and become more extreme.

Countries that plan to increase nuclear power capabilities must, in the same time, secure, in a timely manner, their supply of uranium, either through their national nuclear company or through nuclear companies of other nationalities. Similarly, companies will need to plan strategically ahead.

Indeed, as seen above globally, at country level, the energy security stakes linked to uranium will increase for a country as a threat to its uranium supply will mean its electricity production may become dangerously destabilised. The danger will intensify with the rise of electrification advocated (NZE).

To anticipate further the new world that will be born as we seek to fuel the renewal of nuclear energy, we need to find ways to move beyond a global approach, adapted to the nuclear specificities.

Leave a comment